As the Russia-Ukraine conflict continues to intensify, GAM Investments’ Paul McNamara and Tim Love share their views on the potential implications for Russia and the emerging markets.

23 February 2022

Paul McNamara - Emerging Market Debt

On the night of 21/22 February, Russia moved more troops into the “separatist” parts of the Donetsk and Luhansk oblasts of Ukraine. The already-substantial Russian troop presence in these areas is now official. With this open violation of Ukrainian sovereignty, the long-awaited sanctions are now being imposed.

In our view, Russian assets look extremely undervalued at present and the macroeconomic fundamentals appear sound, but we believe the political risks justify an underweight position.

In the short term, the key question is whether Russia is content to keep the Luhansk and Donetsk “Republics” within current borders, or whether it seeks to extend to the whole of these two oblasts. The Russian/”separatist” territory is some way short of half of these oblasts; an attempt to expand the regions would very likely result in open warfare, and an escalation of sanctions. It seems unlikely that Ukrainian forces would win such a confrontation. So far accounts of what Russia recognises as these Republics are conflicting.

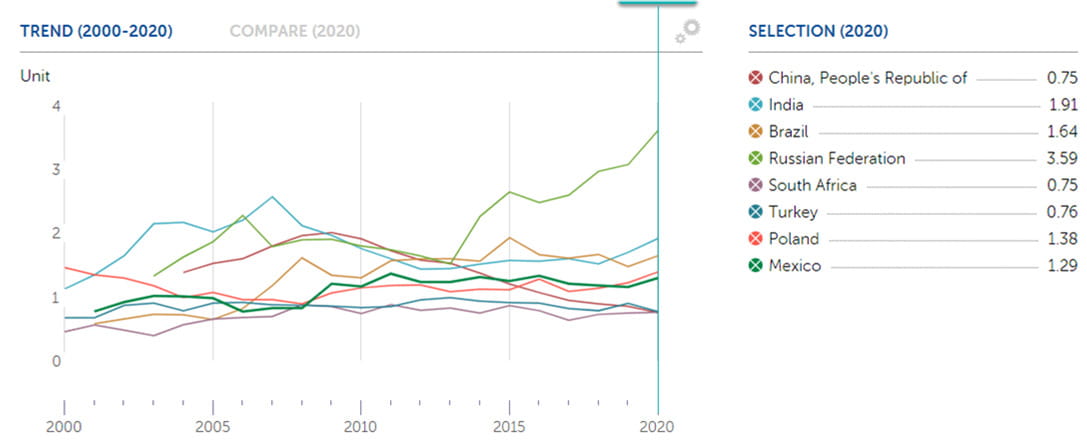

We do not believe the Russian economy is particularly vulnerable to sanctions. With very little government debt, a balance of payments surplus and the strongest foreign exchange reserve position in emerging markets (EM), Russia does not depend on external capital to a material degree, so sanctions aimed to reduce capital inflows will gain little traction.

Russian reserve adequacy versus other emerging markets (a score of one is deemed ‘adequate’ by the IMF)

With that said, sanctions can create considerable fluctuations in financial markets, and the weakness of Russian asset prices this year reflects priced in sanctions.

So far European sanctions, especially the (at least temporary) decision not to certify the Nord Stream 2 gas pipeline to Germany, have been at the aggressive end of our expectations, though it will be some time before we can draw any confident conclusions.

At present, it seems likely that conditions for foreign investment in Russian assets will become more difficult, but such investment will remain legal. The valuation levels remain important, and despite fundamentals we are more minded to reduce than to increase exposure. We are watching for the announcement of further sanctions.

Most encouraging is the lack of contagion to EM more broadly. Even currencies such as the Polish zloty, which had been quite correlated with the Russian ruble, no longer appear to be, and traditional risk bellwethers such as the South African rand or Turkish lira did not sell off, while the Brazilian real has been very strong. We think only the Kazak tenge is a serious contagion risk (and of course the Ukrainian hryvnya).

Tim Love – Emerging Markets Equities

It is important to remember that the MSCI Emerging Markets index has morphed considerably. Russia makes up only 2.8% of MSCI EM. China/Taiwan/Korea and India between them make up 72% of the index, all of which are oil importers. We expect the drive to alternatives and liquefied natural gas (LNG) to be accelerated by these geopolitics. India is particularly sensitive to an oil price above USD 100 per barrel, which would impact its fiscal accounts and planned infrastructure spending projections (which would have to be scaled back).

Saudi Arabia, South Africa, Brazil and Mexico make up a further 17% of MSCI EM. The remainder is Thailand, Indonesia and the Philippines (5.5%) and the Gulf (Qatar/Bahrain) at 3% followed by EMEE (Poland/Hungary) at 2%. Some of these countries are oil exporters while others are self-sufficient.

We believe the bigger issue for EM relates to oil prices. Sanctions on Russia would lead to a rise in oil prices and an overall rise in EM equity risk premia. We believe this would be positive for Saudi Arabia and oil stocks in EM as a whole, but negative for Eastern Europe. Overall, higher oil prices also act as a tax on North East Asia as many industries have issues with pass through of higher oil prices.

Russia itself is relatively sanction-proof with huge fiscal, current account and international reserve surpluses.

In the event of a Minsk-2 agreement being hammered out and a full invasion of Kiev being ruled out, we would take a more positive view on Russia.

Should a clear invasion of Ukraine/Kiev occur with Russian troops, much deeper sanctions would be expected. The issue of clarity would arise should hybrid economic warfare occur designed to generate a regime change to a pro-Moscow government without troops. We expect the western response to be split in that scenario, but in general would be more intense should it occur before the US midterms in November 2022. In that scenario, we continue to see opportunities across EM, such as Saudi Arabia and Qatar, both of which will be direct beneficiaries.

The biggest implication, in our view, is that any EM state that is asked to denuclearise will certainly now not do so, as the territorial integrity cannot be guaranteed unless that country is a NATO member or an individual nuclear state. As a result, we see the world as becoming more dangerous.

The information in this document is given for information purposes only and does not qualify as investment advice. Opinions and assessments contained in this document may change and reflect the point of view of GAM in the current economic environment. No liability shall be accepted for the accuracy and completeness of the information. Past performance is not a reliable indicator of future results or current or future trends. The mentioned financial instruments are provided for illustrative purposes only and shall not be considered as a direct offering, investment recommendation or investment advice. The securities listed were selected from the universe of securities covered by the portfolio managers to assist the reader in better understanding the themes presented and are not necessarily held by any portfolio or represent any recommendations by the portfolio managers. There is no guarantee that forecasts will be realised.