03 August 2023

Ad hoc announcement pursuant to Art. 53 Listing Rules: GAM Holding AG announces first half 2023 results

Financial highlights

- Total assets under management (AuM) were CHF 68.0 billion as at 30 June 2023, with Investment Management at CHF 21.9 billion and Fund Management Services at CHF 46.1 billion, compared to a total of CHF 75.0 billion as at 31 December 2022.

- The reduction in Investment Management AuM was driven by net outflows of CHF 2.2 billion offset by positive market movement and foreign exchange movements of CHF 0.9 billion.

- Fund Management Services saw net outflows of CHF 6.9 billion, partially offset by net positive market and foreign exchange movements of CHF 1.2 billion.

- Investment performance continues to be strong. Year to date as at 30 June 2023, 71% of AuM in GAM funds outperformed their respective benchmarks. Over three-years, 90% of AuM outperformed their respective benchmarks, compared to 55% as at 31 December 2022.

- Underlying loss before tax was CHF 22.5 million compared to CHF 15.4 million for the first half of 2022.

- IFRS net loss was CHF 71.2 million compared to CHF 275.2 million for the first half of 2022.

David Jacob, Chairman GAM Holding AG said: “Our first half results demonstrate the challenges which GAM faces, which are among the reasons why the Board continues to recommend the Liontrust offer to GAM shareholders. Our investment teams continue to excel, but the need for corporate stability is essential to give our clients confidence to allocate to our strategies. The stable platform and investment that will be provided by the combined group, once the Liontrust offer is completed, gives our shareholders an opportunity to participate in future value creation.”

Assets under management movements (CHF bn)

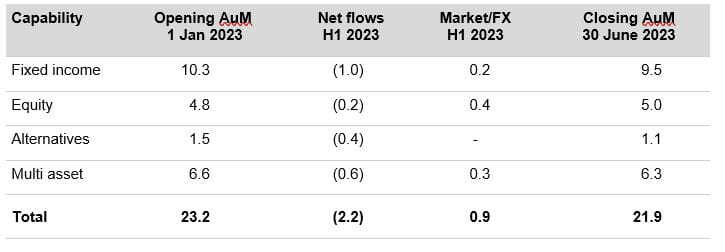

Net flows by capability

Our fixed income strategies saw net client outflows of CHF 1.0 billion. In equities, net outflows amounted to CHF 0.2 billion, and our multi asset strategies saw outflows of CHF 0.6 billion. Alternatives recorded net outflows of CHF 0.4 billion.

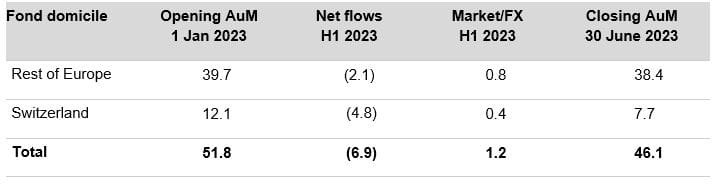

Assets under management movements (CHF bn)

As at 30 June 2023, AuM decreased to CHF 46.1 billion from CHF 51.8 billion as at 31 December 2022, with net outflows of CHF 6.9 billion partially offset by net positive market and foreign exchange movements of CHF 1.2 billion.

IFRS net loss after tax was CHF 71.2 million, compared with CHF 275.2 million in the first half of 2022. The loss in the first half of 2023 was mainly driven by the underlying net loss after tax of CHF 23.9 million and non-core items of CHF 47.3 million. Non-core items include the impairment of legacy brand intangible of CHF 43.2 million which was originally created by the acquisition of GAM by Julius Baer in 2005.

Net management fees and commissions in the first half of 2023 totalled CHF 68.0 million, down from CHF 90.9 million in the first half of 2022 due primarily to lower average assets under management.

Underlying net performance fees totalled CHF 3.3 million, increased from CHF 2.6 million in the first half of 2022.

Underlying personnel expenses decreased by 21% to CHF 49.0 million in the first half of 2023, compared with CHF 62.1 million in first half of 2022. Fixed personnel costs decreased by 14%, driven by continued lower headcount. Headcount stood at 519 FTEs as at 30 June 2023, compared with 541 FTEs as at 31 December 2022 and 594 FTEs as at 30 June 2022. Variable compensation fell to CHF 6.4 million from CHF 12.5 million in the first half of 2022, mainly due to lower management fees. This compares to IFRS personnel expenses of CHF 49.2 million. The difference between the underlying and the IFRS personnel expenses of CHF 0.2 million relates to a reorganisation costs.1

Underlying general expenses were CHF 34.3 million, down from CHF 37.9 million in the corresponding period last year. Decreases in costs related to technology, data and research and occupancy. This compares to IFRS general expenses of CHF 37.7 million. The difference between the underlying and the IFRS general expenses of CHF 3.4 million mainly relates to the professional and consulting fees.

The underlying operating margin stood at negative 28.5%, compared with negative 17.1 % in the first half of 2022, primarily driven by a 22.2% fall in net fee and commission income, partially offset by the 21% decline in personnel and general expenses.

The underlying pre-tax loss was CHF 22.5 million, compared to a CHF 15.4 million underlying pre-tax loss in the first half of 2022. The loss was driven mainly by lower net fee and commission income partially offset by lower personnel and lower general expenses. This compares to an IFRS net loss before tax of CHF 70.6 million.

The underlying income taxes was a tax expense of CHF 1.4 million, representing effective tax rate of negative 6.2% compared a tax credit of CHF 1.4 million the first half of 2022. The movement in the effective tax rate was primarily driven by changes in a tax credit between H1 2023 and a tax charge in H1 2022.1

Diluted underlying losses per share were negative CHF 0.15, compared to negative of CHF 0.09 in the first half of 2022 resulting from the underlying net loss. This compares to a diluted IFRS earnings per share of negative CHF 0.45.

Cash and cash equivalents as at 30 June 2023 were CHF 83.6 million, down from CHF 137.9 million as at 31 December 2022 and CHF 171.7 million as at 30 June 2022. This reduction was driven by the underlying loss, annual bonus payments relating to 2022 and the impact of cash classified as assets held for sale (CHF 23.5 million) as at 30 June 2023.

Adjusted tangible equity as at 30 June 2023 was CHF 47.9 million, down from CHF 68.7 million as at 31 December 2022 and CHF 164.3 million as at the end of 30 June 2022. The main contributors to this decrease were the IFRS net loss after tax (adjusted for intangibles), pension remeasurements, investment in the platform and foreign exchange movements. See page 26 of our Annual Report 2022 for full definition of adjusted tangible equity.

As at 30 June 2023, the Group had no financial debt, as in previous years. However, in July 2023 the Group drew down on its loan facilities with Liontrust Asset Management PLC.

Materials relating to the results (Half Year Report and press release) are available at www.gam.com.

| 18 August 2023 | Extraordinary General Meeting |

| 19 October 2023 | Q3 2023 Interim Statement |

| Charles Naylor Head of Communications and Investor Relations T +44 7890 386 699 |

|

| Media Relations Ute Dehn Christen T+41 58 426 31 36 |

|

Visit us at: www.gam.com

Follow us on: Twitter, LinkedIn

GAM

GAM is an independent investment manager that is listed in Switzerland. Total assets under management were CHF 68 billion as at 30 June 2023, with Investment Management at CHF 21.9 billion and Fund Management Services at CHF 46.1 billion. GAM has global distribution with offices in 14 countries and is geographically diverse with clients in almost every continent. It has 3,500 clients globally, of which c. 2,700 are based in Europe. Headquartered in Zurich, GAM Investments was founded in 1983 and its registered office is at Hardstrasse 201 Zurich, 8037 Switzerland.

Liontrust

Liontrust is an independent, specialist asset manager established in 1995, listed on the London Stock Exchange in 1999 and is a member of the FTSE 250. Headquartered on the Strand in London with additional offices in Edinburgh and Luxemburg, Liontrust had £30.5 billion in AuMA as at 16 June 2023. Liontrust seeks to enable investors to enjoy a better financial future through investing in a range of global equities, fixed income, sustainable investment and multi-asset portfolios and funds.

Legal Notice and Information

No Offer

The information contained in this release is for informational purposes only and does not constitute, or form part of, an offer or invitation to purchase, sell, exchange or issue, or a solicitation of an offer to sell, purchase, exchange or subscribe for any registered shares or other securities of GAM Holding AG or Liontrust Asset Management Plc, nor shall it form the basis of, or be relied on in connection with, any contract therefor. This release is not part of the Offer Documentation (as defined below) relating to the exchange offer of Liontrust Asset Management Plc for all publicly held registered shares of GAM Holding AG (the "Offer"). Terms and conditions of the Offer have been and/or will be published in the Offer Documentation (as defined below) regarding the Offer. Shareholders of GAM Holding AG are urged to read the Offer Documentation (as defined below), which is and/or will be available at www.liontrust.co.uk/gam-acquisition.

Certain Offer Restrictions

1. General

The release, publication or distribution of the pre-announcement of the Offer, the offer prospectus relating to the Offer and any other materials relating to the Offer (the "Offer Documentation") and the making of the Offer may in certain jurisdictions (including, but not limited to, Japan) (the "Restricted Jurisdictions") be restricted by law, be considered unlawful or otherwise violate any applicable laws or regulations, or may require Liontrust Asset Management Plc or any of its direct and indirect subsidiaries to change or amend the terms or conditions of the Offer in any way, to make an additional filing with any governmental, regulatory or other authority or take additional action in relation to the Offer. Therefore, persons obtaining any Offer Documentation or into whose possession any Offer Documentation otherwise comes, are required to, and should inform themselves of and observe, all such restrictions. Neither GAM Holding AG nor Liontrust Asset Management Plc nor the receiving agent accept or assume any responsibility or liability for any violation by any person whomsoever of any such restriction. The Offer is not being and will not be made, directly or indirectly, in or into the Restricted Jurisdiction. It is not intended to extend the Offer to any such Restricted Jurisdictions. The Offer Documentation should not be sent or otherwise distributed in or into the Restricted Jurisdictions and the Offer cannot be accepted by any such use, means or instrumentality, in or from within the Restricted Jurisdictions. Accordingly, copies of the Offer Documentation are not being, and must not be, sent or otherwise distributed in or into or from any Restricted Jurisdiction or, in their capacities as such, to custodians, trustees or nominees holding shares for persons in any Restricted Jurisdictions, and persons receiving any such Offer Documentation (including custodians, nominees and trustees) must not distribute or send them in, into or from any Restricted Jurisdiction. Any purported acceptance of the Offer resulting directly or indirectly from a violation of these restrictions will be invalid. No shares are being solicited in the Offer for purchase or sale from or to a resident of the Restricted Jurisdictions and, if sent in response by a resident of the Restricted Jurisdictions, Liontrust Asset Management Plc reserves the right to reject such acceptance. Such Offer Documentation must not be used for the purpose of soliciting the purchase or sale or exchange of any shares in GAM Holding AG (the "GAM Shares") or shares in Liontrust Asset Management Plc (the "Liontrust Shares") by any person or entity resident or incorporated in any Restricted Jurisdiction. Each person delivering an acceptance form in connection with the Offer will be required to certify that, unless and to the extent otherwise agreed with and authorized by Liontrust Asset Management Plc in accordance with applicable law and regulations: (i) such person has not received the Offer, the Offer Documentation, the acceptance form or any other document relating to the Offer in a Restricted Jurisdiction, nor has such person mailed, transmitted or otherwise distributed any such document in or into a Restricted Jurisdiction; (ii) such person has not utilized, directly or indirectly, the mails, or any means or instrumentality of commerce, or the facilities of any national securities exchange, of a Restricted Jurisdiction in connection with the Offer; (iii) such person is not and was not located in a Restricted Jurisdiction at the time such person accepted the terms of the Offer or at the time such person returned the acceptance form; and (iv) if such person is acting in a fiduciary, agency or other capacity as an intermediary, then either (a) such person has full investment discretion with respect to the securities covered by the acceptance form or (b) the person on whose behalf such person is acting was located outside the Restricted Jurisdictions at the time he or she instructed such person to accept the Offer.

Subject to applicable securities laws and regulations, Liontrust Asset Management Plc intends to make available a "vendor placement" arrangement with respect to the Offer for holders of GAM Shares in the United States of America and any other jurisdictions where, in the sole discretion of Liontrust Asset Management Plc, an offer of securities to such persons would require filing of a registration statement with the United States Securities and Exchange Commission (the "SEC") or another relevant regulatory body, or who are otherwise not eligible to participate in the Offer in accordance with applicable laws or regulations. Accordingly, Liontrust Asset Management Plc intends to structure the Offer in a manner whereby each such holder would receive average net cash proceeds from the sale of the Liontrust Shares that it would otherwise be entitled to receive in the Offer (such arrangement, a "Vendor Placement"), unless such holder makes such representations, warranties and confirmations as Liontrust Asset Management Plc may require, and Liontrust Asset Management Plc, in its sole discretion, determines that such holder may receive the Liontrust Shares without filing of a registration statement with the SEC or another relevant regulatory body. Any sale of shares in Liontrust Asset Management Plc pursuant to a Vendor Placement would occur outside of the United States of America and any Restricted Jurisdictions pursuant to a centralized sale process and would be subject to deduction of applicable fees and expenses.

2. United States of America

Shareholders of GAM Holding AG in the United States of America are advised that the GAM Shares are not listed on a U.S. securities exchange and that GAM Holding AG is not subject to the periodic reporting requirements of the U.S. Securities Exchange Act of 1934, as amended (the "Exchange Act"), and is not required to, and does not, file any reports with the SEC thereunder.

The Liontrust Shares to be offered in exchange for GAM Shares pursuant to the Offer have not been and will not be registered under the U.S. Securities Act of 1933, as amended ("U.S. Securities Act"), nor under any law of any state of the United States of America, and may not be offered, sold, resold or delivered, directly or indirectly, in or into the United States of America, except pursuant to an exemption from the registration requirements of the U.S. Securities Act and applicable state securities laws. The Offer Documentation does not constitute an offer to sell or the solicitation of an offer to buy any securities in the United States of America. Liontrust Asset Management Plc will not register or make a public offer of its securities, or otherwise conduct the Offer, in the United States of America.

The securities referred to herein have not been and are not presently expected to be listed on any US securities exchange or quoted on any inter-dealer quotation system in the United States of America. None of GAM Holding AG or Liontrust Asset Management Plc presently intends to take any action to facilitate a market in such securities in the United States of America.

Neither the U.S. Securities and Exchange Commission, nor any U.S. state securities commission, has approved or disapproved of the securities to be offered in exchange for GAM Shares pursuant to the Offer or any related transaction or determined if the information contained herein or in any offering circular to be prepared in connection with the Offer is accurate or complete. Any representation to the contrary is a criminal offense in the U.S.

As used herein, "United States of America", "U.S." or "US" means the United States of America, its territories and possessions (including Puerto Rico, the U.S. Virgin Islands, Guam, American Samoa, Wake Island and the Northern Mariana Islands), any state of the United States of America and the District of Columbia.

3. United Kingdom

The Offer is only being made within the United Kingdom pursuant to an exemption under Regulation (EU) 2017/1129 as it forms part of domestic law by virtue of the European Union (Withdrawal) Act 2018 (as amended and together with any applicable adopting or amending measures in the United Kingdom, the "UK Prospectus Regulation") from the requirement to publish a prospectus that has been approved by the UK Financial Conduct Authority and published in accordance with the UK Prospectus Regulation.

4. European Economic Area

The Offer is only being made within the European Economic Area ("EEA") pursuant to an exemption under Regulation (EU) 2017/1129 (as amended and together with any applicable adopting or amending measures in any relevant member state of the EEA, the "Prospectus Regulation"), from the requirement to publish a prospectus that has been approved by the competent authority in that relevant member state and published in accordance with the Prospectus Regulation or, where appropriate, approved in another relevant member state and notified to the competent authority in that relevant member state, all in accordance with the Prospectus Regulation.

5. Japan

The Offer is not addressed to shareholders of GAM Holding AG whose place of residence, seat or habitual abode is in Japan, and such shareholders may not accept the offer.

Reference is made to the offer prospectus for the full offer restrictions.

Other Important Information

This release contains or may contain statements that constitute forward-looking statements. Words such as “anticipate”, “believe”, “expect”, "estimate", "aim", “project”, “forecast”, "risk", “likely”, “intend”, “outlook”, “should”, “could”, "would", “may”, “might”, "will", "continue", "plan", "probability", "indicative", "seek", “target”, “plan” and other similar expressions are intended to or may identify forward-looking statements.

Any such statements in this release speak only as of the date hereof and are based on assumptions and contingencies subject to change without notice, as are statements about market and industry trends, projections, guidance and estimates. Any forward-looking statements in this release are not indications, guarantees, assurances or predictions of future performance and involve known and unknown risks, uncertainties and other factors, many of which are beyond the control of the person making such statements, its affiliates and its and their directors, officers, employees, agents and advisors and may involve significant elements of subjective judgement and assumptions as to future events which may or may not be correct and may cause actual results to differ materially from those expressed or implied in any such statements. You are strongly cautioned not to place undue reliance on forward-looking statements and no person accepts or assumes any liability in connection therewith.

This release is not a financial product or investment advice, a recommendation to acquire, exchange or dispose of securities or accounting, legal or tax advice. It has been prepared without taking into account the objectives, legal, financial or tax situation and needs of individuals. Before making an investment decision, individuals should consider the appropriateness of the information having regard to their own objectives, legal, financial and tax situation and needs and seek legal, tax and other advice as appropriate for their individual needs and jurisdiction.