The US is experiencing strong economic growth, abundant jobs and positive real wages. But puzzlingly, US consumer surveys reveal a deep and persistent dissatisfaction. Are we on the cusp of a self-fulfilling prophecy, or do further good times lie ahead?

7 March 2024

One of US comedian Louis C.K.’s most famous skits was based on his observation that modern life provided a level of material wealth and convenience that could only be dreamt of decades ago yet no one appeared appreciative or happy as a result. His routine on the subject is worth watching, not least because this dissonance is especially pronounced today in attitudes to the US economic outlook.

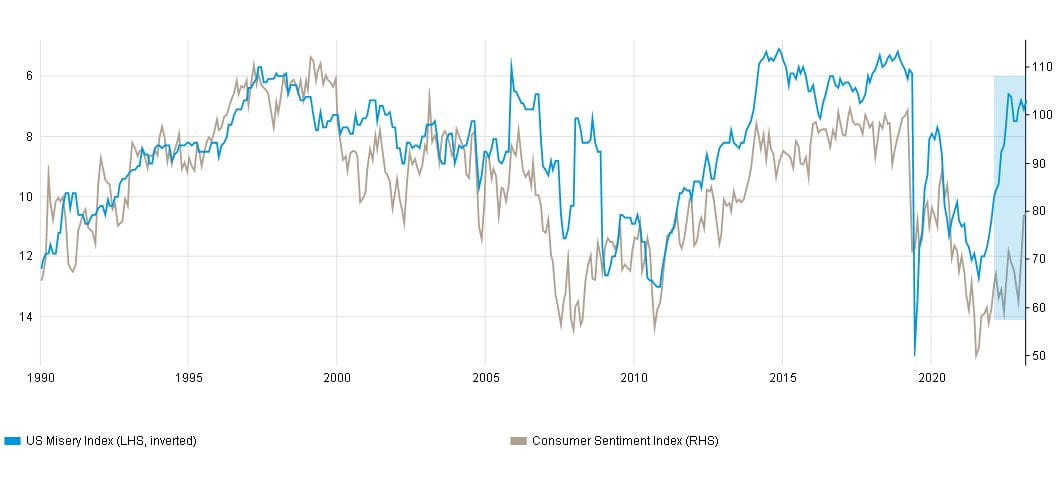

Investors who enjoyed the 25% gain in the US S&P 500 Index since from 27 October 2023 to 29 February this year (source: GAM) may have been surprised - and somewhat unnerved - by just how unhappy US consumers appear to be in the face of increasingly benign economic conditions, according to survey data at least. Measures of consumer mood have remained depressed since the pandemic, with the University of Michigan’s Index of Consumer Sentiment at 79.6 at the February 2024 reading (source: Bloomberg), still well below the 101 level of February 2020.

Similarly, the University of Michigan also reports more Americans interpreting employment news as getting worse rather than better, even with unemployment at a near-record low of just 3.7%. This joylessness matters because US retail investors can move the market, accounting for over 22% of US equity trading volume according to Bloomberg, while Gallup reports that fully 61% of US adults own stocks, the highest proportion since 2008. The key questions investors must therefore grapple with are whether the consumer gloom is justified and, if not, what is driving it, and when is it likely to meaningfully ease? The stakes are high, with the S&P 500 Index trading at a relatively rich 21.1x forward earnings ratio as at 23 February (source: Bloomberg), making it one of the more expensive – and therefore potentially vulnerable – stock markets in the world today (for comparison, the Euro Stoxx 50 Index trades at 13.7x) while also taking up around two thirds of the MSCI AC World Index.

Keep up and cheer up! Consumer sentiment is lagging the improvement in fundamentals:

From 31 Dec 1990 to 29 Feb 2024

Source: Bloomberg, BLS, University of Michigan

US Misery Index defined as sum of inflation and unemployment rates

Plenty of reasons to be cheerful

Starting with the US economy itself, it is surprisingly hard to find bad economic news. The economy was reported to have grown at a robust 3.3% annual rate in the fourth quarter of 2023 (source: Bloomberg), finally putting to rest the recession predicted by many early in 2023. At the start of February this year the non-farm payrolls jobs report revealed a whopping 353,000 jobs had been created in January while the unemployment rate hovers near lows of 3.7%, as previously stated. Average hourly wages have been growing at a healthy 4.5% compared to a year earlier, affording Americans real wage growth of 1.4% given headline Consumer Price Index (CPI) inflation of 3.1% at the latest January reading (source: Bloomberg). In addition to the spending power from wages, the Boston Federal Reserve concluded in a recent study that American consumers still have a cool USD 200 billion in their pockets left over to spend from pandemic relief payments. To round off the positive picture, the generally easing inflation trajectory has seen markets price in a not unreasonable three interest rate cuts by the Federal Reserve before the end of this year, potentially bringing the Fed Funds rate down to 4.75%. Collectively, these are little short of Goldilocks conditions, describing a steadily growing economy with plentiful jobs, individual spending power and a balanced inflation and interest rate outlook. And from a stock market perspective, all this should be helpful for corporate earnings too.

A legacy of Covid? It’s proving tough to M.A.G.A. (Make America Grin Again)

Consumer unhappiness seems therefore ‘unjustified’ in the face of such a strong economy and becomes even more of a mystery when one considers that it is in fact consumption itself that has been driving recent economic growth. Psychology may have a role in explaining the apparent dissonance. The concept of hedonic adaptation describes how people suffering extreme life occurrences, whether tragic or triumphant, end up reverting to a ‘middle state’ of mood and sentiment after a time. This could explain why US consumers are apparently so indifferent to circumstances that their counterparts in other economies would surely be grateful for. But this theory seems unconvincing when one considers that America’s Goldilocks economy is quite a new phenomenon. As recently as January 2023, headline CPI in the US was running at an eye-watering 6.4%, with wage growth of just 4.6% (source: Bloomberg). Wage growth really only started winning out against inflation after the pandemic in April last year, so ‘sticker shock’ remains fresh in most people’s minds.

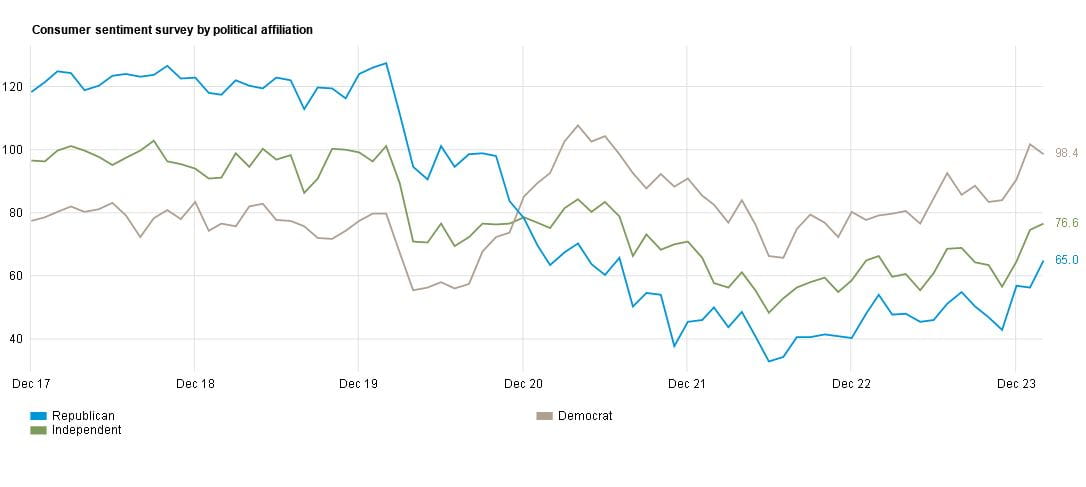

Similarly, the International Monetary Fund (IMF) predicted in their January 2023 World Economic Outlook Update that full-year US Gross Domestic Product (GDP) growth would be just 1.4% when in fact US GDP ended up growing at a rather livelier 3.1% for the year (source: Bloomberg). All this suggests that consumer sentiment has simply not had a chance to recover from the trauma of the pandemic (including over 1.1 million US lives lost according to the Centers for Disease Control and Prevention), the lockdowns and the economic after-effects. Exhorting consumers to ‘cheer up’ now that the economy is just starting to work in their favour again seems a little unrealistic. And of course there is another driver suppressing the mood music for longer, namely America’s political polarisation. The origins of this deserve separate treatment of course, but suffice it to say that today’s divisions are acute. Republican voters seem especially depressed consumers today, with surveys (see chart below) revealing them to be even unhappier than when the pandemic broke out in 2020.

Republicans are actually unhappier now than at the outbreak of pandemic:

From 31 Dec 2017 to 29 Feb 2024

Source: Bloomberg, University of Michigan

It is true that not much can be done about the politics in an election year and with Donald Trump now leading the polls over Joe Biden (according to realclearpolling.com as of 20 February), the assumption must be that Democrats would become similarly depressed if a Republican candidate, especially Donald Trump, were to win. But beyond the politics investors should not be excessively concerned at the mental state of the US consumer. While Americans appear unhappy with their lot for the time being, this is not translating into reining back of spending or the yanking of funds out of the stock market at the aggregate level. Inflation remains on a broadly cooling trajectory and even if it were to settle now around the 3% mark or just below, it would feel a lot more manageable on the ground than at its peak of 9.1% in mid-2022 (source: Bloomberg). Real spending power remains firmly positive today and echoes of the pandemic will surely fade in time (remember face masks?). Added to which, the very latest surveys are pointing to a gradual uptick in sentiment.

It might be too soon right now, but Louis C.K.’s riffing about misery in the face of fundamentally good times might raise a smile again among Americans before too long. Investors are right to be watchful on stretched valuations in US markets but they should be reassured that US consumers are not about to become a source of weakness. Indeed, coupled with strong earnings in the technology sector, they may even help drive a continuation of the strong rally seen since October last year. In the meantime, let them be grumpy for a little while longer. The last few years have provided plenty of reasons after all.

The information contained herein is given for information purposes only and does not qualify as investment advice. Opinions and assessments contained herein may change and reflect the point of view of GAM in the current economic environment. No liability shall be accepted for the accuracy and completeness of the information contained herein. Past performance is no indicator of current or future trends. The mentioned financial instruments are provided for illustrative purposes only and shall not be considered as a direct offering, investment recommendation or investment advice or an invitation to invest in any GAM product or strategy. Reference to a security is not a recommendation to buy or sell that security. The securities listed were selected from the universe of securities covered by the portfolio managers to assist the reader in better understanding the themes presented. The securities included are not necessarily held by any portfolio or represent any recommendations by the portfolio managers. Specific investments described herein do not represent all investment decisions made by the manager. The reader should not assume that investment decisions identified and discussed were or will be profitable. Specific investment advice references provided herein are for illustrative purposes only and are not necessarily representative of investments that will be made in the future. No guarantee or representation is made that investment objectives will be achieved. The value of investments may go down as well as up. Investors could lose some or all of their investments.

The foregoing views contains forward-looking statements relating to the objectives, opportunities, and the future performance of markets generally. Forward-looking statements may be identified by the use of such words as; “believe,” “expect,” “anticipate,” “should,” “planned,” “estimated,” “potential” and other similar terms. Examples of forward-looking statements include, but are not limited to, estimates with respect to financial condition, results of operations, and success or lack of success of any particular investment strategy. All are subject to various factors, including, but not limited to general and local economic conditions, changing levels of competition within certain industries and markets, changes in interest rates, changes in legislation or regulation, and other economic, competitive, governmental, regulatory and technological factors affecting a portfolio’s operations that could cause actual results to differ materially from projected results. Such statements are forward-looking in nature and involve a number of known and unknown risks, uncertainties and other factors, and accordingly, actual results may differ materially from those reflected or contemplated in such forward-looking statements. Prospective investors are cautioned not to place undue reliance on any forward-looking statements or examples. None of GAM or any of its affiliates or principals nor any other individual or entity assumes any obligation to update any forward-looking statements as a result of new information, subsequent events or any other circumstances. All statements made herein speak only as of the date that they were made.