Following the fallout of the Credit Suisse collapse in March, a dislocation between fundamentals and valuations has persisted in the Additional Tier 1 (AT1) market. Atlanti’s Romain Miginiac discusses how a return to the ‘status quo’ of robust earnings, new issues and banks calling creates a positive environment for AT1s.

05 October 2023

European Bank AT1s – Act II: Normalisation

Since our last note on Additional Tier 1 (AT1) contingent convertibles (CoCos) earlier this year, the dislocation between European banks’ fundamentals and valuations has persisted. Wide spreads, double digit yields and elevated pricing of extension risk seem at odds with strong earnings in Q1 and Q2 and more than 90% of AT1s called. So why are we getting paid double digit yields on “A” rated issuers? After Act I: Survival post-Credit Suisse, the AT1 market is now set for Act II: Normalisation. As bondholders oftentimes no news is the best news, and here we suspect the catalyst is the ‘status quo’ – robust earnings, new issues, banks calling. On top of high carry, the potential for material spread tightening and re-pricing to call have created a favourable environment for AT1s – which we see as the sweet spot in the current environment.

Going concern, the storm in a teacup

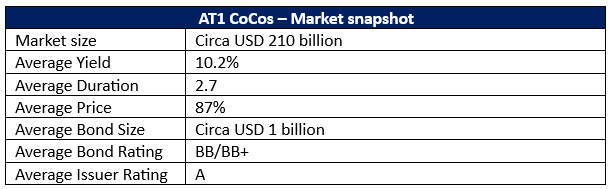

Table 1: AT1 CoCos market snapshot

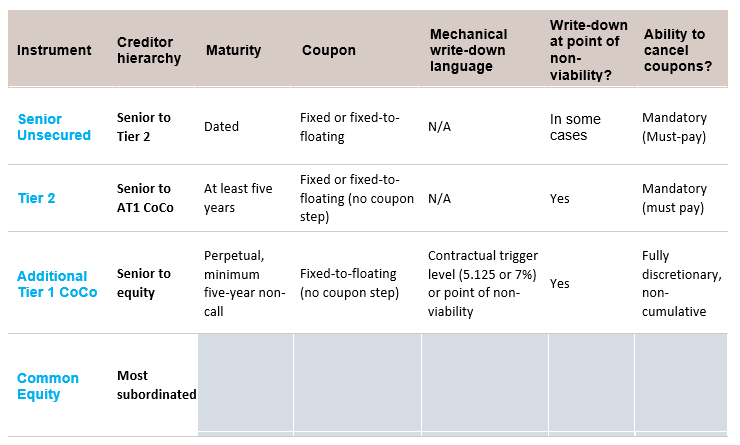

In a nutshell – AT1s offer strong credit quality, liquidity and high yields in the higher beta credit space – in exchange for subordination risk. Approximately a decade and over USD 300 billion of supply since the birth of the asset class, the AT1 market has now matured, and features and risks are well understood. These key features are summarised in the table below, and key risks are:

- Principal loss: AT1 CoCos are written down or converted into equity when a bank’s Common Equity Tier 1 (CET1) capital ratio falls below a pre-defined trigger level (5.125 or 7%), or when the regulator has deemed that the bank has reached the point of non-viability.

- Coupon risk: Coupons on AT1s are fully discretionary and non-cumulative (cancelled coupons are foregone), with issuers and regulators having full flexibility to cancel coupons. Coupons are also automatically cancelled in the case that a bank’s capital ratio falls below banks’ MDA trigger (Maximum Distributable Amount, typically minimum regulatory capital requirement)

- Extension risk: AT1s are fully perpetual, callable periodically, with no economic incentive to redeem (no coupon step). This leads to the risk that bonds may not be called at their next call date, and in the worst case left outstanding forever.

Table 2: Key features of AT1s in the bank capital structure

In theory, principal loss and coupon risk may seem intolerable as their consequence is severe. In practice, banks operate with capital levels well above trigger or MDA levels, hence these risks are remote. As an example, HSBC had a 14.7% CET1 ratio as of Q2 2023, compared to a 10.9% MDA trigger and 7% trigger. In absolute terms, this is USD 33 billion and USD 66 billion of excess capital, respectively. Adding HSBC’s circa USD 35-40 billion of expected pre-provision profits (profits available to absorb loan losses and other losses) in FY23-25 on top, this implies the capacity to absorb circa USD 70 billion of losses before coupons on AT1s are at risk. To illustrate, this represents circa 8x the loan loss provisions set aside in 2020 during Covid-19.

Chart 1: HSBC’s earnings and capital buffers to protect AT1 holders are substantial

Events of European bank AT1s being written-down have been rare, with only two occurrences so far – Banco Popular in 2017 and Credit Suisse (CS) in 2023. The latter has led to fears around AT1s going full circle, back to the earlier days of principal loss fears, as investors moved on to coupon risk briefly and ultimately extension risk. This has re-sparked the debate around AT1s’ going concern purpose – the ability for AT1s to absorb losses before a bail-in (and potentially before shareholders). In practice, write-downs have occurred due to regulators using their powers (viability assessment) – actual or quasi-resolution events, while the debate around creditor hierarchy has been rapidly quashed in the EU/UK. Given regulators’ limited ability to impose losses on AT1 holders without fully impairing shareholders, going concern risk is largely theoretical (outside of Switzerland). While it could also be argued that coupon risk is a potential source of going concern risk, in practice this has not occurred – even ahead of AT1s being written-down.

Dislocated valuations: currently paid too much, but poised to normalise.

With above 500 bps of spread (option-adjusted spread (OAS) to treasury) and circa 10% yield, it is difficult to find a lens through which AT1s do not screen well, in our view. Post Credit Suisse, Act I of the AT1 market’s rise from the (feared) ashes, survival is mainly ensured – spreads, while elevated, remain acceptable for issuers to refinance existing bonds. Nevertheless, AT1s have lagged significantly year-to-date, as spreads are still materially wide (circa 100 bps) of February levels, while investment grade (IG) and high yield (HY) are at, or near, the tightest levels. If justified by fundamentals, then Act II – a normalisation of spreads to tighter levels – is the path of least resistance.

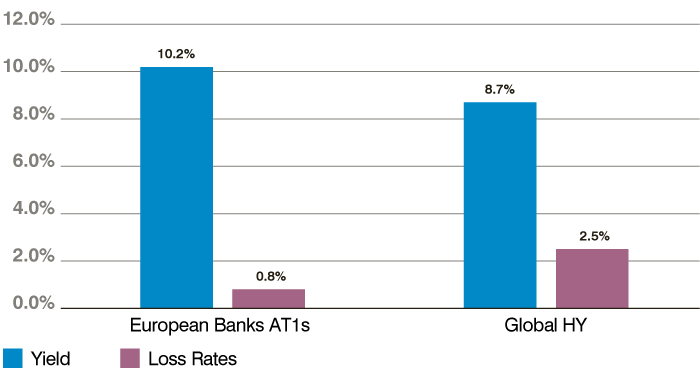

With around a decade of track record, a good picture of the risks in the AT1 market is starting to emerge – benign losses despite 2023 as an outlier. Putting the total of circa USD 19 billion of AT1s written down in context, this is equivalent to an annualised loss rate below 1% over 2014-2023 (albeit losses have been lumpy as very rare events in a relatively concentrated asset class). A good comparison for compensation for default risks is the HY market. Currently, AT1s offer 1.5% higher yield compared to global high yield with materially lower loss rates (see chart below). AT1s trade at historically wide levels compared to the HY market – likely to correct as the AT1 market continues to deliver low losses.

Chart 2: European bank AT1s offer higher yields with lower historical loss rates.

High quality European issuers currently need to pay up circa 100 bps to issue AT1s compared to equivalent US banks. For example, BNP issued an AT1 CoCo in August at a yield of 8.5% compared to 7.5% for Goldman Sachs a few days later.

Paradoxically, European banks have proved to be quite immune to issues facing large US banks. Q1 and Q2 results of European banks have confirmed what was expected; no material outflows of deposits, unrealised losses on bonds portfolios are not a concern, commercial real estate exposures are limited and skewed towards high quality. One ‘fun fact’ to illustrate the gap between both banking systems – Bank of America alone has accumulated more unrealised losses on its amortized cost bond portfolio (high quality govvies held for liquidity) than the whole eurozone banking sector put together (circa EUR 100 billion versus circa EUR 80 billion).

Q1 and Q2 earnings have also highlighted the bright spot of European banks’ report cards – strong profitability. After a decade of lackluster return on equity (RoE) compared to US counterparts, European banks are now expected to deliver a higher RoE.

The equity story around banks’ earnings momentum may or may not be over – as bondholders the stock matters, not the flow. An expected circa 10-11% RoE in 2023 to 2025 is definitely supportive for bondholders, adding a huge buffer of earnings to absorb potential losses. Most European banks could absorb Global Financial Crisis-style loan losses through earnings alone – credit positive.

All-time-high capital metrics, post-eurozone crisis low non-performing loan (NPL) ratios, strong earnings – the sector’s credit metrics have never been so solid, in our view. Future earnings releases will continue to act as a periodic reminder.

Chart 3: European banks’ finally delivering strong earnings (consensus RoE for the next 12 months)

The strong track record of AT1 calls cannot be ignored forever.

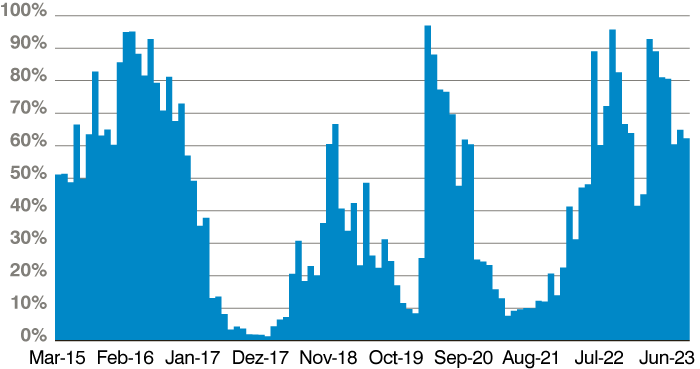

Extension risk is another topic where perception and reality clash. This is especially apparent as 2023 will not be remembered as an outlier – 92% of AT1s with their first call date in 2023 having been redeemed so far. This compares to circa 94% over the long-term, meaning that out of USD 117 billion of AT1s having reached their first call date since the birth of the market, USD 109 billion were called.

Looking out to 2024, out of the circa USD 30 billion of AT1s up for call, at least 80% are (conservatively) expected to be called and most likely 2024 will end up with more than 90% of bonds called.

Against this backdrop of bonds being called at their first call date, pricing of extension risk still reflects a gloomy outlook for call decisions. Close to two-thirds of AT1s are still priced to perpetuity, reflecting fears around issuers’ ability to refinance bonds.

The experience from 2023 continues to emphasise that non-calls will remain the exception rather than the norm. For 2024, between AT1s that have already been pre-financed, those that could be replaced at a similar or lower cost, a lot of upcoming calls are already safe. On top of this, adding the willingness from most European banks to pay some incremental cost, and banks’ ability to call without refinancing by using excess capital – this leaves limited call uncertainty.

This reinforces the thesis that valuations on AT1s are cheap relative to US preference shares, as the bondholder friendly approach of European banks differs from US banks that are focused on maximizing value for shareholders. Higher certainty of call should lead to a lower risk premium and hence tighter spreads, all else equal.

Chart 4: Despite a stellar track record, circa two-thirds of AT1s are expected to skip their next call date

The case for AT1 CoCos remains intact in our view, with a clear dislocation between fundamentals and valuations. The ‘status quo’ catalyst – ongoing strong earnings from the sector in upcoming quarters and bonds called at par – supports a normalisation of spreads. While investors in AT1s benefit from very high carry, potential for spread tightening and bonds re-pricing to call leaves the door open for price appreciation – sizeable overall total returns looking at the next 12 to 24 months.

The information contained herein is given for information purposes only and does not qualify as investment advice. Opinions and assessments contained herein may change and reflect the point of view of GAM in the current economic environment. No liability shall be accepted for the accuracy and completeness of the information contained herein. Past performance is no indicator of current or future trends. The mentioned financial instruments are provided for illustrative purposes only and shall not be considered as a direct offering, investment recommendation or investment advice or an invitation to invest in any GAM product or strategy. Reference to a security is not a recommendation to buy or sell that security. The securities listed were selected from the universe of securities covered by the portfolio managers to assist the reader in better understanding the themes presented. The securities included are not necessarily held by any portfolio nor represent any recommendations by the portfolio managers nor a guarantee that objectives will be realized. References to indexes and benchmarks are hypothetical illustrations of aggregate returns and do not reflect the performance of any actual investment. Investors cannot invest in indices which do not reflect the deduction of the investment manager’s fees or other trading expenses. Such indices are provided for illustrative purposes only. Indices are unmanaged and do not incur management fees, transaction costs or other expenses associated with an investment strategy. Therefore, comparisons to indices have limitations. There can be no assurance that a portfolio will match or outperform any particular index or benchmark.

This article contains forward-looking statements relating to the objectives, opportunities, and the future performance of the U.S. market generally. Forward-looking statements may be identified by the use of such words as; “believe,” “expect,” “anticipate,” “should,” “planned,” “estimated,” “potential” and other similar terms. Examples of forward-looking statements include, but are not limited to, estimates with respect to financial condition, results of operations, and success or lack of success of any particular investment strategy. All are subject to various factors, including, but not limited to general and local economic conditions, changing levels of competition within certain industries and markets, changes in interest rates, changes in legislation or regulation, and other economic, competitive, governmental, regulatory and technological factors affecting a portfolio’s operations that could cause actual results to differ materially from projected results. Such statements are forward-looking in nature and involve a number of known and unknown risks, uncertainties and other factors, and accordingly, actual results may differ materially from those reflected or contemplated in such forward-looking statements. Prospective investors are cautioned not to place undue reliance on any forward-looking statements or examples. None of GAM or any of its affiliates or principals nor any other individual or entity assumes any obligation to update any forward-looking statements as a result of new information, subsequent events or any other circumstances. All statements made herein speak only as of the date that they were made.