30 July 2019

GAM Holding AG announces H1 2019 results

- Underlying profit before taxes of CHF 2.1 million, with diluted underlying EPS of CHF (0.01) compared with CHF 0.45 in H1 2018

- IFRS net loss of CHF 13.6 million, with diluted IFRS EPS of CHF (0.09) compared with CHF 0.16 in H1 2018

- Net fee and commission income down to CHF 171.1 million from CHF 287.7 million in H1 2018 as a result of substantially lower levels of investment management assets under management (AuM)

- Group AuM, including investment management and private labelling, at CHF 136.1 billion1 as at 30 June 2019 compared with CHF 132.2 billion2 as at 31 December 2018

- Investment management:

- AuM totalled CHF 52.1 billion1 as at 30 June 2019 compared with CHF 56.1 billion2 as at 31 December 2018; net outflows of CHF 7.6 billion3, partially offset by positive net market and foreign exchange movements of CHF 3.6 billion

- Improving flow trend in June and July month-to-date, both with positive net inflows

- Management fee margin of 53.9 basis points (bps) in H1 2019 stable compared with December 2018 exit margin of 54 bps

- Private labelling:

- AuM as at 30 June 2019 increased to a record high of CHF 84.0 billion compared with CHF 76.1 billion as at 31 December 2018; net inflows of CHF 2.4 billion combined with positive net market and foreign exchange movements of CHF 5.5 billion

- Management fee margin of 4.3 bps in H1 2019, in line with the guidance for 2019 of approximately 4 bps

- Peter Sanderson appointed Group CEO, effective 1 September 2019, as announced separately today

- Unconstrained/absolute return bond funds (ARBF) liquidation completed

- Final payments to clients made today with an average of over 100%4 of portfolio value being returned

- GAM has agreed with Tim Haywood that neither party will pursue the other based on current facts

- On track with implementation of restructuring programme

- Reduction of fixed personnel and general expenses of at least CHF 40 million is on track, with a minimum of one third of the savings to be achieved in 2019 and the full benefit in 2020

- Further simplification of the business with additional efficiency gains expected in 2020/2021

- Sale of precious metals and money market funds to Zürcher Kantonalbank (ZKB)

- GAM entered into an agreement with ZKB to sell its precious metals and money market funds, which as at 30 June 2019 had AuM of CHF 2.2 billion. The transaction is expected to close in Q3 2019

David Jacob, Group CEO, said: “With the final ARBF payments being made to our clients today, we intend to put this issue behind us and are now fully focused on the future growth of the business. I am pleased that we have started to see a positive flow trajectory in investment management over the last couple of months. We are well on track with the implementation of our restructuring programme and will continue to find ways to simplify our business to achieve additional efficiency gains. Further stabilising the business, rebuilding client trust and a focus on areas where we have recognised expertise will get us back on track to deliver attractive returns for our shareholders.”

Net fee and commission income decreased 41% to CHF 171.1 million compared with CHF 287.7 million in H1 2018, driven by significantly lower average AuM in investment management and a reduction in the management fee margins for investment management and private labelling. Performance fees increased to CHF 5.4 million from CHF 2.3 million in the same period last year, mainly driven by GAM’s systematic and specialist fixed income strategies.

Net other income, which includes net interest income and expenses, the impact of foreign exchange movements, net gains and losses on seed capital investments and hedging as well as fund-related fees and service charges, were a net expense of CHF 3.8 million compared with CHF 0.7 million in H1 2018. This was mainly driven by the impact of the new IFRS lease standard adopted in January 2019 resulting in higher interest charges as well as lower rental income due to the London office move and net seed capital losses.

Personnel expenses were CHF 104.0 million, a decrease of 19% from CHF 128.9 million in H1 2018. Variable compensation was down 41% compared with H1 2018, primarily due to lower accruals for contractual and discretionary bonuses, driven by lower revenues. Fixed personnel costs decreased by 5%, driven by lower headcount, which declined from 935 full-time equivalents (FTEs) as at 30 June 2018 to 863 FTEs as at 30 June 2019.

General expenses were CHF 52.1 million, down 18% from CHF 63.9 million in the same period last year. This was mainly driven by the implementation of restructuring measures as well as the application of the new IFRS lease standard as of January 2019. The latter resulted in a shift of occupancy-related expenses from general expenses to depreciation and amortisation.

The operating margin in H1 2019 was 3.4% compared with 32.0% in H1 2018. This was driven by a decrease in net fee and commission income that was only partly offset by a decrease in expenses.

The underlying pre-tax profit was CHF 2.1 million compared with CHF 91.3 million in H1 2018, driven by lower net management fees and commissions only partly offset by lower expenses.

The underlying tax expense for H1 2019 was CHF 3.2 million. The disproportionate level of tax compared with profits was driven by non-taxable holding company costs and the impact of expenses which are not tax deductible.

The diluted underlying earnings per share were negative CHF 0.01 compared with a diluted underlying earnings per share of CHF 0.45 in H1 2018. This was the result of the underlying net loss in H1 2019, compared to a profit in the same period last year.

The IFRS net loss was CHF 13.6 million compared with a net profit of CHF 25.4 million in the same period last year. This change mainly reflects the net underlying loss compared to profits in the same period last year, partly offset by an impairment charge in H1 2018 relating to Cantab investment management and client contracts (IMCCs).

The IFRS net loss includes two items that are not included in the underlying results: non-recurring items and acquisition-related items resulted in a charge of CHF 7.0 million and CHF 5.5 million respectively (all net of taxes). The former mainly includes costs related to ARBF matters and restructuring costs. Acquisition-related items mainly related to the amortisation of IMCCs from previously acquired businesses and finance charges on deferred consideration liabilities.

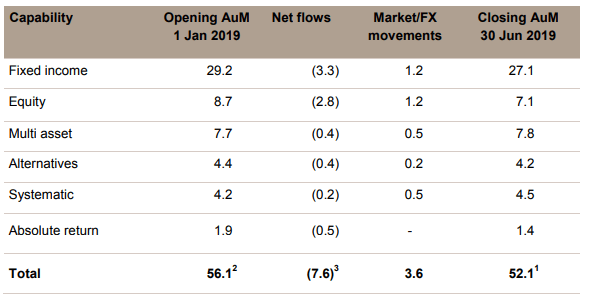

AuM movements (in CHF bn)

Net outflows in investment management amounted to CHF 7.6 billion3 in H1 2019, partly offset by positive net market and foreign exchange movements of CHF 3.6 billion. This resulted in AuM of CHF 52.1 billion1 as at 30 June 2019, down from CHF 56.1 billion2 at year-end 2018.

Net flows by capability

Our specialist fixed income strategies saw net outflows of CHF 3.3 billion. The majority of these outflows were recorded in the money market-like GAM Greensill Supply Chain Finance fund, with large inflows and outflows being characteristic of this business. The GAM Emerging Bond and GAM Local Emerging Bond funds as well as some institutional mandates also recorded client redemptions, while the GAM Star Credit Opportunities and the GAM FCM Cat Bond funds saw net inflows.

In equity, net outflows amounted to CHF 2.8 billion, mainly driven by client redemptions from the GAM Star Asia Pacific Equity, GAM Star Continental European Equity, GAM Japan Equity, GAM Star China Equity and the GAM Euroland Value Equity funds.

Multi asset strategies experienced net outflows of CHF 0.4 billion, primarily driven by redemptions from private clients.

Alternatives recorded net outflows of CHF 0.4 billion, primarily reflecting outflows from the GAM Physical Gold and GAM Commodity funds which were partly offset by inflows into an existing Swiss institutional mandate.

Systematic saw net outflows of CHF 0.2 billion, as net outflows from the CCP Core Macro and CCP Quantitative funds were only partly offset by inflows into the GAM Systematic Alternative Risk Premia Plus fund.

Absolute return recorded net outflows of CHF 0.5 billion3, which were primarily driven by redemptions from the GAM Star (Lux) European Alpha, GAM Star Global Rates and GAM Absolute Return Europe funds.

Investment performance

Over the three-year period to 30 June 2019, 77% of AuM in funds outperformed their respective benchmark compared with 66% as at 31 December 2018. This increase was primarily driven by the outperformance of certain equity strategies. Over the five-year period to 30 June 2019, 75% of AuM in funds outperformed their respective benchmark, up from 63% as at 31 December 2018. Over 80% of GAM’s AuM tracked by Morningstar5 outperformed their respective peer groups over the three and five year periods to 30 June 2019.

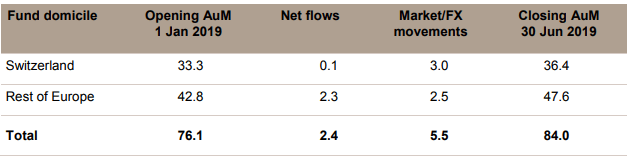

AuM movements (in CHF bn)

AuM in private labelling rose to CHF 84.0 billion as at 30 June 2019, up from CHF 76.1 billion at year-end 2018. Net inflows of CHF 2.4 billion came from existing clients, and net market and foreign exchange movements had a positive impact of CHF 5.5 billion.

Cash and cash equivalents were CHF 251.3 million, down from CHF 328.2 million as at 31 December 2018, primarily reflecting compensation payments for the 2018 financial year as well as acquisition-related deferred consideration payments and expenditures made in relation to the restructuring programme.

Tangible equity as at 30 June 2019 was CHF 174.4 million compared with CHF 184.6 million at year-end 2018. The decrease was primarily driven by the IFRS net loss reported in H1 2019.

The Group’s dividend policy targets a minimum pay-out ratio of 50% of the underlying net profit.

On 30 July 2019, GAM completed the liquidation of its ARBF strategies and, as of that date, will have returned on average 100.5%4 of net asset value to clients relative to the valuations at the time the liquidation of the respective funds commenced. This marks an important milestone for GAM.

Throughout the liquidation process, GAM’s priority has been to maximise liquidity and value for its clients while treating all investors fairly. It believes that taking decisive action was the right and only thing to do and that it is important for GAM, entrusted as it is with its clients’ money, to always uphold the highest standards of care. GAM knows that this has been a difficult year for all its stakeholders, including clients who were invested in the ARBF strategy, but it believes that it has taken the right steps. GAM announced the need to liquidate the funds as soon as it became apparent that to do otherwise would hamper its ability to treat clients fairly, immediately stopped charging management fees on the impacted funds, was transparent in its projections of payback intervals and achieved almost all of those milestones in a timely manner. These actions resulted in critical value preservation for clients invested in the ARBF.

GAM is focused on the future of the business, and while it stands by its finding of gross misconduct, it has agreed with Tim Haywood that neither party will pursue the other based on current facts.

GAM has entered into an agreement with ZKB to sell its precious metals and money market funds, with combined AuM of CHF 2.2 billion as at 30 June 2019. The fair value of the total consideration is expected to be CHF 14.0 million and will be fully paid in cash at completion. We believe that, given ZKB’s already strong position in this business, clients will benefit from this transaction which is expected to close during Q3 2019. GAM will continue to act as the fund management company through its private labelling business, while ZKB will be responsible for the investment management and the distribution of the funds.

The market environment is expected to remain volatile and clients are likely to remain cautious and price sensitive. However, with its distinctive set of investment strategies and global distribution capabilities, GAM is well positioned to help clients achieve their investment goals. As previously announced, GAM expects that full-year 2019 underlying pre-tax profit will be materially below the levels in 2018, driven by a significantly lower AuM base. GAM remains fully focused on further stabilising and simplifying the business and focusing on areas where it has recognised expertise to generate attractive shareholder returns.

2Excluding CHF 1.45 billion ARBF-related AuM in liquidation as at 31 December 2018.

3Excluding CHF 0.5 billion ARBF-related AuM liquidated during H1 2019.

4Representing the AuM-weighted average of the amount of each fund to be returned to investors as percentages of the net asset value of the relevant fund as at 3 September 2018 for Luxembourg and the Cayman funds and as at 4 September 2018 for the Ireland funds. The percentage of assets to be returned to investors range between 99.7% and 101.4% depending on the respective fund in question.

5The peer group comparison is based on ‘industry-standard’ Morningstar Direct Sector Classification. The share class preferences in Morningstar have been set to capture the oldest institutional accumulation share class for each and every fund in a given peer group.

The presentation for media, analysts and investors of the H1 2019 results of GAM Holding AG will be webcast on 30 July 2019 at 8:30am (CEST). Materials relating to the results (presentation slides, H1 2019 report and press release) are available at www.gam.com.

| 17 October 2019 | Q3 2019 Interim management statement |

| 20 February 2020 | Full-year results 2019 |

| 23 April 2020 | Interim management statement Q1 2020 |

| Media Relations: | Investor Relations: | |||

| Marc Duckeck | Patrick Zuppiger | |||

| T +41 (0) 58 426 62 65 | T +41 (0) 58 426 31 36 | |||

| Tobias Plangg | Jessica Grassi | |||

| T +41 (0) 58 426 31 38 | T +41 (0) 58 426 31 37 | |||

Visit us at: www.gam.com

Follow us on: Twitter, LinkedIn

GAM is a leading independent, pure-play asset manager. The company provides active investment solutions and products for institutions, financial intermediaries and private investors. The core investment business is complemented by private labelling services, which include management company and other support services to third-party asset managers. GAM employs around 860 people in 14 countries with investment centres in London, Cambridge, Zurich, Hong Kong, New York, Milan and Lugano. The investment managers are supported by an extensive global distribution network. The Group has AuM of CHF 136.1 billion (USD 139.6 billion) as at 30 June 2019, excluding ARBF-related AuM of CHF 1.0 billion in liquidation at that point in time.

Headquartered in Zurich, GAM is listed on the SIX Swiss Exchange and is a component of the Swiss Market Index Mid (SMIM: until 20 September 2019) with the symbol ‘GAM’.

This press release by GAM Holding AG (‘the Company’) includes forward-looking statements that reflect the Company’s intentions, beliefs or current expectations and projections about the Company’s future results of operations, financial condition, liquidity, performance, prospects, strategies, opportunities and the industry in which it operates. Forward-looking statements involve all matters that are not historical facts. The Company has tried to identify those forward-looking statements by using words such as ‘may’, ‘will’, ‘would’, ‘should’, ‘expect’, ‘intend’, ‘estimate’, ‘anticipate’, ‘project’, ‘believe’, ‘seek’, ‘plan’, ‘predict’, ‘continue’ and similar expressions. Such statements are made on the basis of assumptions and expectations which, although the Company believes them to be reasonable at this time, may prove to be erroneous.

These forward-looking statements are subject to risks, uncertainties, assumptions and other factors that could cause the Company’s actual results of operations, financial condition, liquidity, performance, prospects or opportunities, as well as those of the markets it serves or intends to serve, to differ materially from those expressed in, or suggested by, these forward-looking statements. Important factors that could cause those differences include, but are not limited to: changing business or other market conditions, legislative, fiscal and regulatory developments, general economic conditions, and the Company’s ability to respond to trends in the financial services industry. Additional factors could cause actual results, performance or achievements to differ materially. The Company expressly disclaims any obligation or undertaking to release any update of, or revisions to, any forward-looking statements in this press release and any change in the Company’s expectations or any change in events, conditions or circumstances on which these forward-looking statements are based, except as required by applicable law or regulation.