21 April 2021

GAM Holding AG interim management statement for the three-month period to 31 March 2021

- Group AuM of CHF 124.5 billion1 compared to CHF 122.0 billion as at 31 December 2020

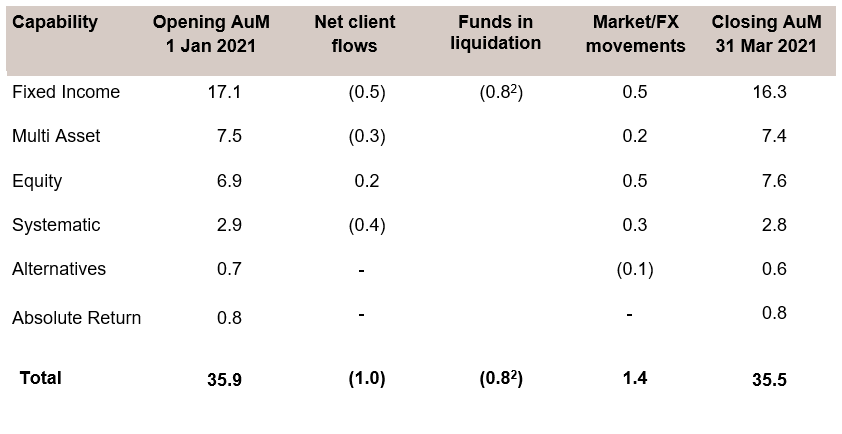

- Investment Management AuM at CHF 35.5 billion, with net client outflows of CHF 989 million and positive market and foreign exchange (FX) of CHF 1.4 billion

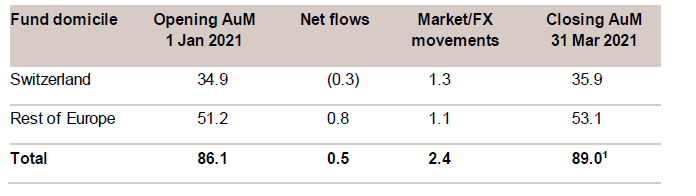

- Private Labelling with AuM of CHF 89.01 billion, with net inflows of CHF 502 million and positive market and FX movements of CHF 2.4 billion

- Strong investment performance with 92% of assets under management outperforming their benchmark over five years

- Several GAM funds named winners of 2021 Refinitiv Lipper Awards for consistent outperformance

- Successful launch of the GAM Sustainable Local Emerging Bond strategy

- All Equity portfolios now live on the new SimCorp platform

- On track to deliver CHF 15 million savings in fixed staff costs and general expenses in FY 2021

Peter Sanderson, Group CEO, said: “I am pleased with the continued progress of our strategy and, although we saw outflows in investment management, we are seeing encouraging client activity on the back of strong investment performance. We are delivering well on our highly scalable, efficient operating platform which enables us to leverage the growth opportunities offered by our market-leading strategies.”

As at 31 March 2021, Group AuM totalled CHF 124.5 billion1 up from CHF 122.0 billion at the end of 2020.

Investment Management

AuM totalled CHF 35.5 billion, down from CHF 35.9 billion compared to 31 December 2020, with net client outflows of CHF 989 million and funds in liquidation of CHF 0.8 billion2, offset by positive market and foreign exchange movements of CHF 1.4 billion.

Net flows by capability

In specialist fixed income, we recorded net outflows of CHF 0.5 billion, primarily driven by allocation decisions by clients in the GAM Star Credit Opportunities and GAM Local Emerging Bond funds.

Multi asset remained flat with inflows in our Multi Asset Active and Managed Fund Solutions and outflows from some institutional mandates.

In equities, we saw strong investment performance resulting in net inflows of CHF 0.2 billion. While this positive development was driven by a variety of funds across the capability, the main drivers were our GAM Star Japan Equity, GAM Star European Equity as well as our GAM Star Disruptive Growth strategies.

In systematic, net outflows totalled CHF 0.4 billion and were mainly driven by client asset allocation decisions in GAM Systematic Core Macro and GAM Systematic Multi Strategy funds.

Both alternatives and absolute return net client flows remained flat.

Assets under management movements (CHF bn)

Investment performance

As at 31 March 2021, 40% and 92% of AuM in investment management outperformed their benchmarks compared to 23% and 70% as at the end of December 2020 and 37% and 70% outperformed their respective Morningstar3 peer group over the three- and five-year periods compared to 56% and 61%, respectively.

Our equity investment strategies have delivered strong performance with 63% and 87% of AuM outperforming their respective benchmarks over three- and five-years, with many strategies in the top quartile or top decile relative to their Morningstar3 peer groups across time periods. Our fixed income strategies saw strong year-to-date performance resulting in 98% of total AuM outperforming their benchmark over five years.

Private Labelling

Our Private Labelling business reported AuM of CHF 89.0 billion1 up compared to CHF 86.1 billion as at 31 December 2020. Net inflows of CHF 0.5 billion primarily from existing clients were further supported by positive market and foreign exchange movements of CHF 2.4 billion.

Assets under management movements (CHF bn)

As communicated on 26 January 2021, a client in our Private Labelling business has given notice that they will be transferring their business to another provider as a part of a broader strategic relationship with that entity. As at 31 March 2021, the related AuM stood at CHF 20.0 billion. The majority of assets will be transferred in the second half of 2021 and the associated annualised revenues are approximately CHF 5 million.

- Successful launch of the GAM Sustainable Local Emerging Bond strategy with CHF 277 million of assets under management

- GAM Stewardship Report published with enhanced levels of transparency

- GAM certified as a CarbonNeutral® company

- New climate bond strategy planned to launch in the second quarter of this year

- Refinitiv Lipper Fund Awards rewarding consistent outperformance of individual funds and fund companies

- The GAM funds recognised include: GAM Star Credit Opportunities, GAM Star Alpha Technology, GAM Swiss Small & Mid Cap Equities, GAM Swiss Equities

- The focus will now be on GAM Systematic Core Macro and GAM Systematic Alternative Risk Premia

- Alternative Risk Premia was already planned to move onto the new SimCorp platform, Core Macro will now also move onto the platform

- Realignment will, amongst other benefits, give us an enhanced ability to provide sustainable versions of the strategies as part of a wider focus on sustainability

- The implementation of a new cloud-based SimCorp platform is core to GAM’s efficiency plan

- All Equity portfolios have now been transferred onto the new platform

- By the end of 2021, all our investment portfolios will be on the platform, providing a resilient backbone to our operations and the capability to deliver enhanced levels of service and reporting for our clients

- On track to deliver further CHF 15 million of savings in fixed personnel and general and administrative expenses during the full year 2021

- Our guidance remains unchanged

- Based on the maturities of the underlying notes, payments to clients will be distributed in an orderly manner

- To date, investors have received 70% of their total assets (as at 5 March 2021), the remainder of payments will be distributed as underlying notes continue to mature over the next nine months

- The fund is an investment grade only strategy with payment obligations from globally recognised multinational corporations and has continued to receive all scheduled maturity payments from the notes in which it is invested

- GAM’s associated run rate revenues from this fund were approximately CHF 1 million per annum. As of 2 March 2021, GAM (Luxembourg) S.A. as the appointed Alternative Investment Fund Manager has waived its investment management fees on the fund

Despite continued market volatility which can impact client demand, GAM believes that it is well positioned to help clients navigate these challenging times by offering a diverse range of actively managed products and solutions through a global distribution footprint. GAM believes that its scalable and simplified operating model will enable the firm to efficiently capture growth opportunities, while remaining alert to risks in a fast-changing market environment. The case for active management remains strong in the face of continuing market volatility, and we expect client engagement to remain constructive over the coming months.

2 GAM Greensill Supply Chain Finance Fund SCSp, the liquidation of which was announced on 2 March 2021.

3 The peer group comparison is based on ‘industry-standard’ Morningstar Direct Sector Classification. The share class references in Morningstar have been set to capture the oldest institutional accumulation share class for each and every fund in a given peer group.

| 29 April 2021 | Annual General Meeting |

| 4 August 2021 | Half-year results 2021 |

| 21 October 2021 | Q3 2021 Interim management statement |

| Charles Naylor Global Head of Communications and Investor Relations T +44 20 7917 2241 |

|

| Investor Relations Jessica Grassi T +41 58 426 31 37 |

|

| Media Relations Ute Dehn Christen T+41 58 426 31 36 |

Media Relations Kathryn Jacques T +44 20 7393 8699 |

Visit us at: www.gam.com

Follow us on: Twitter, LinkedIn

About GAM

GAM is a leading independent, pure-play asset manager. The company provides active investment solutions and products for institutions, financial intermediaries and private investors. The core investment business is complemented by private labelling services, which include management company and other support services to third-party asset managers. GAM employed 701 FTEs in 14 countries with investment centres in London, Cambridge, Zurich, Hong Kong, New York, Milan and Lugano as at 31 December 2020. The investment managers are supported by an extensive global distribution network. Headquartered in Zurich, GAM is listed on the SIX Swiss Exchange with the symbol ‘GAM’. The Group has AuM of CHF 124.5 billion1 (USD 132.3 billion) as at 31 March 2021.

Disclaimer regarding forward-looking statements

This press release by GAM Holding AG (‘the Company’) includes forward-looking statements that reflect the Company’s intentions, beliefs or current expectations and projections about the Company’s future results of operations, financial condition, liquidity, performance, prospects, strategies, opportunities and the industry in which it operates. Forward-looking statements involve all matters that are not historical facts. The Company has tried to identify those forward-looking statements by using words such as ‘may’, ‘will’, ‘would’, ‘should’, ‘expect’, ‘intend’, ‘estimate’, ‘anticipate’, ‘project’, ‘believe’, ‘seek’, ‘plan’, ‘predict’, ‘continue’ and similar expressions. Such statements are made on the basis of assumptions and expectations which, although the Company believes them to be reasonable at this time, may prove to be erroneous.

These forward-looking statements are subject to risks, uncertainties, assumptions and other factors that could cause the Company’s actual results of operations, financial condition, liquidity, performance, prospects or opportunities, as well as those of the markets it serves or intends to serve, to differ materially from those expressed in, or suggested by, these forward-looking statements. Important factors that could cause those differences include, but are not limited to: changing business or other market conditions, legislative, fiscal and regulatory developments, general economic conditions, and the Company’s ability to respond to trends in the financial services industry. Additional factors could cause actual results, performance or achievements to differ materially. The Company expressly disclaims any obligation or undertaking to release any update of, or revisions to, any forward-looking statements in this press release and any change in the Company’s expectations or any change in events, conditions or circumstances on which these forward-looking statements are based, except as required by applicable law or regulation.