At GAM Investments’ latest Active Thinking forum, David Dowsett reviews the latest market developments while Niall Gallagher explains why he believes the recent outperformance of the European equity market versus US equities is likely to continue.

18 January 2023

David Dowsett, Global Head of Investments

The market over the past five days has been very similar to the first week of the year, with strong overall performance and particularly strong outperformance of non-US assets. I think this has been broadly driven by two things: the better economic outlook in Europe, as least on a marginal basis, as low gas prices continue to filter through and secondly, in a global context, the China reopening story that continues to gather pace, both in terms of data and market performance. From a tactical perspective, we think that markets need to avoid getting carried away too quickly – we have moved a long way in a short period of time, so it would not be surprising to see some give back over the very short-term. Not all the issues of last year have disappeared and we have some new dynamics to contend with.

As a result of last week’s US CPI number, the market now only prices in a 25 basis points (bps) rise for the 1 February Federal Reserve (Fed) meeting, which we think is realistic and there has been some Fed commentary to that end. It would be a material move slower in terms of interest rate hikes.

We may see some headlines from central banks this week from the Davos meetings, particularly in the European context. European Central Bank President Christine Lagarde is speaking on both Thursday and Friday at Davos. Additionally, there is important data coming out of the UK this week. We think this will be important as the UK has greater uncertainty, and to some degree more pessimism, around it than other economies at this point.

A near-term concern that will likely receive a lot more airtime and focus as we move through the first half of this year is the topic of the debt ceiling, as raised by US Treasury Secretary Janet Yellen on Friday. This poses a potential risk this year. We saw what happened with the election of the Speaker of the House in the US. The Republican Party is extremely fundamentalist on fiscal policy and we believe there will be a lot of brinkmanship with the debt ceiling as we move into the second quarter. This has derailed markets previously and we think it has the potential, more in a US context than a global context, to do so again. This could feed into the theme of outperformance of non-US assets as we move through the year.

Niall Gallagher, Investment Director, European Equities

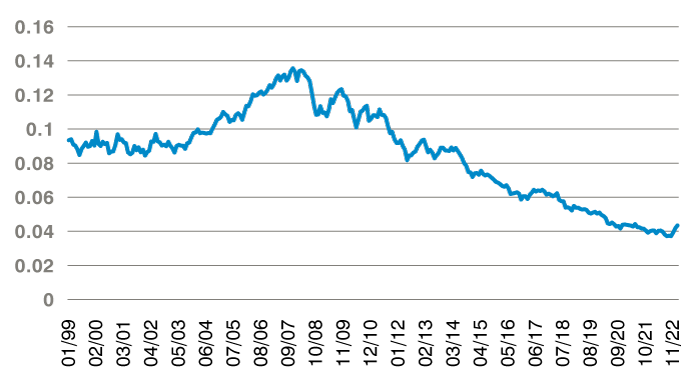

Europe has had a strong start to the year and, notwithstanding any tactical pullbacks, we believe we are now likely to be in a period of outperformance of non-US markets over US markets. Figure 1 shows the performance of the MSCI Europe Index versus the MSCI USA Index from 1998 to 2022 and clearly demonstrates that there is nothing preordained about the US market outperforming non-US markets.

Figure 1: MSCI Europe Index vs. MSCI USA Index, 1 Jan 1998 to 16 Jan 2023

Past performance is not an indicator of future performance and current or future trends.

From the mid-1990s to around 2008, European equities outperformed the US market. The US performed slightly better during the bear market of 2000-1 but from 2001 onwards, European equities bottomed and went on to outperform US equities up until 2008. Since the advent of the Global Financial Crisis through to the end of 2021, the US strongly outperformed Europe. This was extreme in terms of magnitude but also in terms of duration, which has conditioned many to believe that the US market tends to outperform other markets over time. This is not the case. The most recent data demonstrates that this downtrend has technically been broken, with Europe now outperforming the US. It is important to say that this has happened despite continued record outflows from European equities.

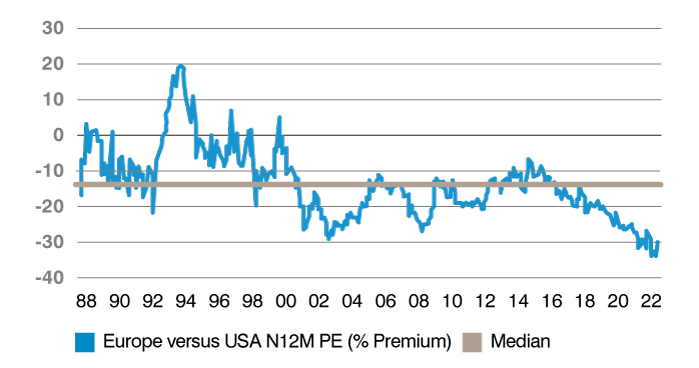

The valuation of Europe compared to the US is at extreme levels. For most of history, there has been a discount of approximately 10% on European equities versus US equities, but over the last decade, that broke down, with the last five years being extreme. Even with the strong outperformance of Europe since the second half of 2022, European equities remain at a deep discount of around 30% to the US.

Figure 2: European PE multiple is still at almost record low to US

Past performance is not an indicator of future performance and current or future trends.

There are some short-term reasons why Europe’s downtrend against the US has been reversed. First, the economic data in Europe, including the UK, has been slightly better than expected. The underlying momentum coming into 2022 was quite strong, but this was knocked off course by the Russian invasion of Ukraine, which impacted Europe through energy markets. Those impacts are not, however, linear across the board. Indeed, in some cases, momentum has remained strong and a good example of this is the consumer sector. We can see this in terms of luxury consumption in Europe, but it is also visible at more mainstream levels. Last week, for example, Ryanair released good numbers and updated the market with some very strong bookings for summer 2023 following an increased level of demand.

More importantly, we have also seen a decrease in gas and electricity prices. We have had some very mild weather over the course of the winter and it has also been quite windy, which has meant we have not needed to import as much gas as we might otherwise have done. In turn, this has brought down the price of gas and we still have strong levels of gas storage. This has also had a knock-on effect on electricity prices which have come down very materially from their peak. With that said, both gas and electricity prices remain high versus history and the underlying fragility remains. Were we to have a cold winter in 2023/4 or were China demand to come back strongly – and China demand has been very weak – we could see much higher gas prices return, but for the moment that has really helped Europe. China’s bounceback in anticipation of the recovery from zero Covid measures, is also very good for European companies, particularly those in the consumer and luxury sectors, but also in areas of industrials too. In addition, the US economic data has been strong and this matters because Asia and the Americas account for approximately 50% of the revenues of the European equity market – most of which are derived from the US and China. Indeed, the US and China combined are around the same size in terms of the revenues of the European equity market as those revenues derived from Europe itself. So, the US economy is doing well, and the Chinese economy pulling back into positive territory is very good for Europe too. We have, of course, had a period of very negative sentiment towards Europe which I think has fed the strong bounce this year while earnings momentum remains positive.

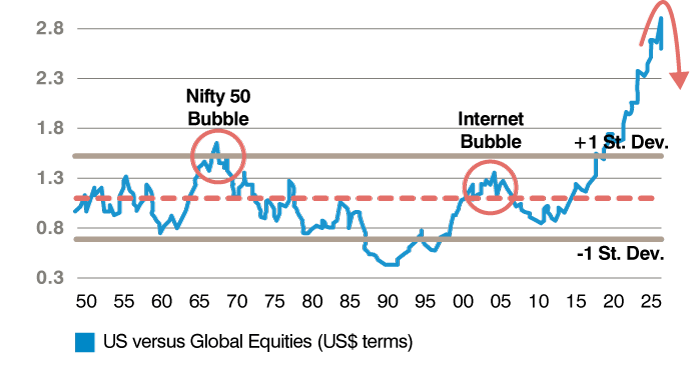

In terms of the longer-term reasons, up to 2010 there was no structural outperformance of US equities versus the rest of the world. There were periods when the US outperformed but it was cyclical rather than structural. Then in 2010 we had an enormous long-term move in US equities versus the rest of the world (coming up to three standard deviations); – that now seems to have reversed.

Figure 3: Rest of World > US equities

Past performance is not an indicator of future performance and current or future trends.

There are a number of reasons why that might have happened and why it might continue. First, we are entering into a new era. The investment era from 2008/9 to 2021 that was characterised by deflation, particularly within Europe, deleveraging, low energy prices and with labour market effects, seems to be going into reverse and we are now looking to an era of reflation. We might hypothesise that this era of deflation led to an accumulation of the world’s financial capital into the US but as we enter an era of reflation, some of that capital will flow out of the US and non-US equities will begin to benefit more from this reflation than US equities. In terms of thinking about this practically in relation to market composition, the US market has a much higher weighting in technology, biotech and many long duration growth and quality areas while the European market is more exposed to banks, energy and asset heavy industrials. So the move from deflation to reflation, logically, should see European equities outperform US equities, but there is a long way to go. If we are going into a different environment, we might see a number of years where non-US markets outperform US markets quite substantially.

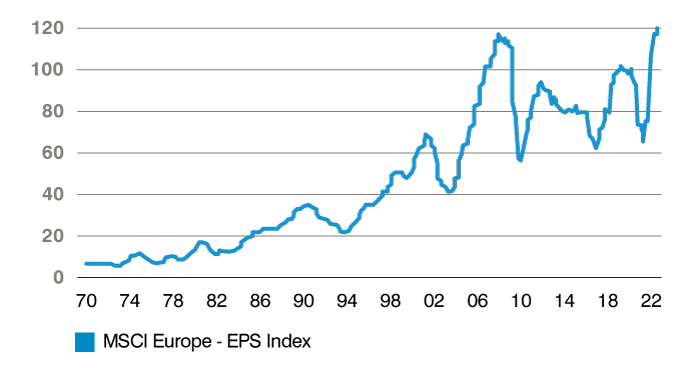

Looking at earnings, it is only now that European earnings have returned to the peak reached in 2007. This means that it has essentially been a 15-year period when earnings in Europe have been in this wasteland for which we know the reasons: the banking sector was a very large part of the index in Europe in 2007, with the advent of zero rates deeply damaging to the profitability of European banks. That has now come to an end. We also had periods of quite low energy prices, low gas prices and materials prices which hit Europe in addition to very low levels of capex, which hit more asset heavy European businesses. We think a more reflationary environment, combined with the transition to net zero, will lead to some much stronger earnings drivers for the European market.

Figure 4: MSCI Europe – EPS Index

Past performance is not an indicator of future performance and current or future trends.

In summary then, we are positive on the outlook for our asset class. Valuations are attractive in absolute terms, very attractive relative to the US and some of the broader macro trends are coming back into favour to allow for a period of what we believe will be decent earnings growth and some sustained performance from the asset class. That is occurring at a time when the sentiment towards European equities is still negative and asset allocations are at a record low.

The information in this document is given for information purposes only and does not qualify as investment advice. Opinions and assessments contained in this document may change and reflect the point of view of GAM in the current economic environment. No liability shall be accepted for the accuracy and completeness of the information. Past performance is no indicator of current or future trends. The mentioned financial instruments are provided for illustrative purposes only and shall not be considered as a direct offering, investment recommendation or investment advice. Reference to a security is not a recommendation to buy or sell that security. The securities listed were selected from the universe of securities covered by the portfolio managers to assist the reader in better understanding the themes presented. The securities included are not necessarily held by any portfolio or represent any recommendations by the portfolio managers.