Emerging market (EM) hard currency sovereign yields are now at their highest level since the global financial crisis, excluding the Covid-induced sell off in March 2020, says Richard Briggs.

16 May 2022

2022 has been a difficult year for EM hard currency debt, with total returns on the JP Morgan EMBI Global Diversified Index at -17% as of 9 May 2022, driven by continuous headwinds from US interest rate normalisation, stagflation fears, the conflict in Ukraine and now concerns about rising Covid cases in China. As it stands, if 2022 ended today, it would be the worst year since 1994 for hard currency EM.

With that, the asset class has now repriced substantially and, in our view, the risks inherent in EM hard currency bonds are now well compensated for. The opportunity to generate alpha is also particularly high, in our view, given the large macro disruptions which are affecting EM which will create more differentiated performance. A bumpy road ahead is still likely, but we think now is a particularly appealing entry point.

Overweight in high yield, but by no means all of it

We think an overweight in EM high yield (HY) should be considered by investors as a priority in the current environment, but the backdrop is not without challenges. In our view, that is why we believe an actively managed process for EM hard currency is key right now.

Valuations are favourable, but the war in Ukraine is likely to persist, keeping commodity and food prices elevated and the outlook for US interest rate normalisation also remains uncertain. We think that favouring those issuers which may benefit from higher commodity prices should provide insulation from the risk of further geopolitical risks feeding into commodity markets.

US interest normalisation, if it persists, is likely to weigh hardest on investment grade (IG) duration and those HY issuers which have high near-term external financing needs given new issue markets are likely to remain challenging in our view.

Pakistan, Egypt, Kenya and Turkey are all obvious examples, in our view, where external financing needs were high prior to the war in Ukraine and, as those countries are highly dependent on commodity imports, the conflict has made them even more vulnerable.

The coming months will be key to understanding whether inflation is likely to drop from elevated levels or whether stagflation risks are higher than expected. That will be important to monitor going forward and may change our view, but for now we believe keeping risk on the table, with a preference for commodity exporters, is likely the right approach.

The backdrop is challenging but valuations are particularly favourable

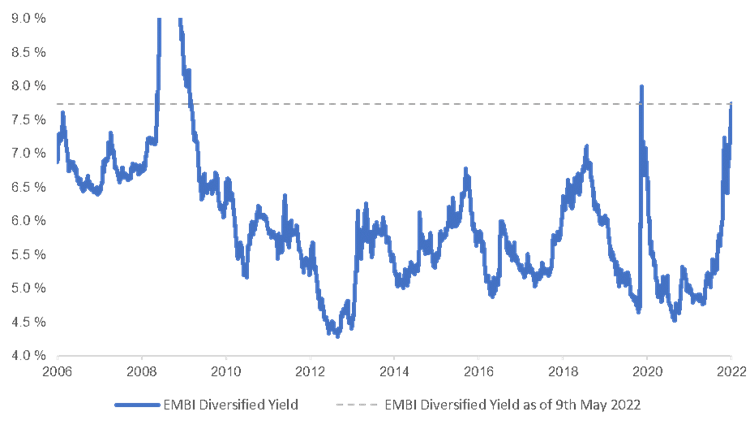

Part of the reason we are still favouring EM HY is because the valuation backdrop is now very favourable. The yield on the EMBI Diversified, which now excludes Russia, stands at 7.7% as of 9 May. That is very high relative to the past two decades outside of the crisis periods in 2008 and 2020, as illustrated in the chart below.

Chart 1: JP Morgan EMBI Diversified Index

Past performance is not a reliable indicator of future results or current or future trends. For illustrative purposes only. Indices cannot be purchased directly.

Some of that yield is due to the defaulted issuers including Zambia and Sri Lanka, but even when adjusting for those within the benchmark, it still stands at a particularly high 6.9%, in our view.

That raises the hurdle to negative returns over anything but a very short time frame unless there is a sharp rise in defaults beyond those which are already priced in Zambia, Sri Lanka, Lebanon, El Salvador and several others.

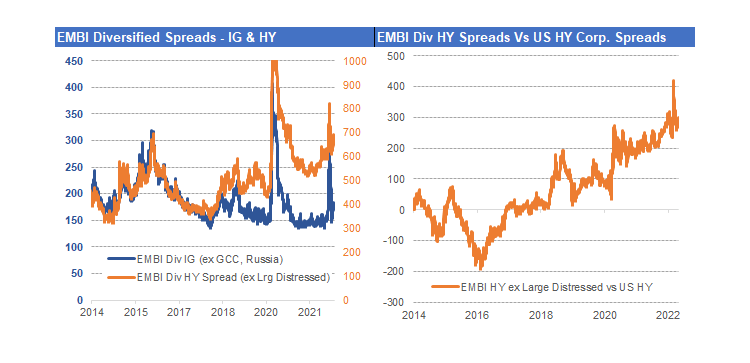

The rise in US Treasury yields is part of the story, but spreads in EM HY sovereigns are also at particularly elevated levels, both when compared to EM IG sovereigns and their US HY corporate counterparts.

In our view, even if spreads simply tread water or widen modestly from here, the hurdle to negative returns over a 12 month or longer holding period is now significantly higher than it was a year ago.

Chart 2: JP Morgan EMBI Diversified spreads – IG and HY; JP Morgan EMBI Diversified HY spreads versus US HY corporate spreads

Past performance is not a reliable indicator of future results or current or future trends. For illustrative purposes only. Indices cannot be purchased directly.

Prices, too, are at their lowest levels as of 9 May 2022, outside of the extreme sell offs in March 2020 and during the global financial crisis. Downside risk should be reduced by the fall in cash prices on EM bonds. Single B and CCC hard currency sovereign bonds (when excluding those which have already missed payments) carry average prices of just over 80 cents on the dollar, with almost one in 10 of those issuers trading with prices below 50 cents.

The asset class is clearly not without risk, but we believe compensation for that risk is now increasingly well compensated for.

The information in this document is given for information purposes only and does not qualify as investment advice. Opinions and assessments contained in this document may change and reflect the point of view of GAM in the current economic environment. No liability shall be accepted for the accuracy and completeness of the information. There is no guarantee that forecasts will be achieved. The mentioned financial instruments are provided for illustrative purposes only and shall not be considered as a direct offering, investment recommendation or investment advice. Assets and allocations are subject to change. Past performance is no indicator for the current or future development.