On the surface, the economic backdrop appears to have improved in recent months, with some commentators having seized upon this as evidence of a new ‘goldilocks’ period in the economy. GAM Investments’ Julian Howard examines whether this is a realistic scenario over the short-, medium- and long-term.

23 March 2023

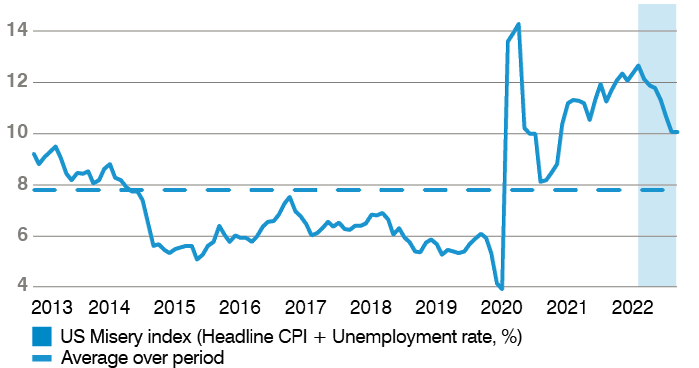

2022 was a torrid year for markets by almost any definition. Inflation rose, monetary policy (interest rates) started to tighten and the value of most mainstream assets adjusted downwards as a result. Despite being beyond the memory of most market participants and commentators, comparisons with the 1970s abounded in an effort to provide some kind of framework to the perfect storm being experienced. Then something changed; the seeds of a more benign set of conditions began to be planted in the autumn and culminated in January of this year. These included a softening of US inflation, both in the official core and headline numbers, but also an easing of global supply chains as shipping costs and delays came down. At the same time, dire predictions of recession suddenly appeared to be excessively pessimistic and have since been hastily revised, with the Wall Street Journal reporting that a recent survey of economists put the risk of recession at a less-than-unanimous 61%. Taking the so-called ‘Misery index’ (a simple sum of the US unemployment and inflation rates), at least on the surface the economic backdrop certainly appears to have improved in recent months with consumers in jobs and seeing improvements in real spending power. Commentators have seized upon all this as evidence of a new ‘goldilocks’ period in the economy, with the promise of accordingly better returns for investors. But what exactly is a goldilocks economy and is it really a realistic scenario in the short to medium term?

Figure 1: A bit less misery - is a new goldilocks phase upon us?

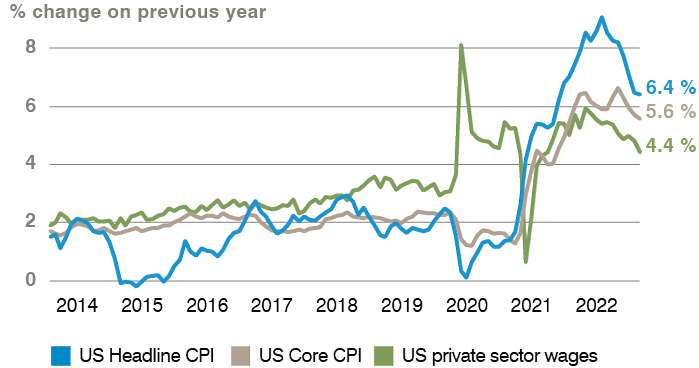

Perhaps the best example of a goldilocks economy was the US in 1983. After the recession of 1981-2, inflation got as low as 2.5%, unemployment fell from 11% to 9% over the course of the year and the economy grew a healthy 4.6% in real terms. The stock market liked these ‘neither too strong nor too weak’ conditions, with the S&P 500 adding a whopping 22.5% that year and going on to deliver a positive return until the early 1990s recession. Comparisons with today are understandable – to a point. US unemployment is just 3.6%, consensus GDP growth for 2023, as surveyed by Bloomberg, has now risen to 0.75%, as at the end of February, from just 0.3% at the start of the year. As for inflation, at 6.4% the US headline rate has come down from the 9.1% peak in the middle of last year. The stock market has been positive, with the S&P 500 and MSCI AC World indices up 14.5% and 18.4%, respectively, in USD terms from 12 October 2022 to the end of January this year. However, this is where the comparison ends. With low inflation, the US Federal Reserve (Fed) of 1983 was able to drop rates from a heady 15% to 8.5% over the course of the year. This is still high by today’s standards but was heading in the right direction. Fast forward to 2023, and the Fed has been at pains to say that more interest rate rises are to be expected. Both the Fed and the market – based on readings of the so-called ‘dot plot’ and interest rate futures – are now in broad agreement that interest rates will still need to rise to over 5.0%, significantly higher than where rates were barely a year ago and perhaps as much as two more rate hikes from where they are now. As the minutes of the latest Fed rate-setting meeting at the start of February sternly observed: “The Committee anticipates that ongoing increases in the target range will be appropriate in order to attain a stance of monetary policy that is sufficiently restrictive to return inflation to 2 percent over time.” A strong US labour report and a sideways (rather than outright lower) inflation print during February forced markets to take note, with the S&P 500 down over -2% on the month and the inflation-sensitive 10-year US Treasury yield touching nearly 4.0%. For the stock market, the interest rate issue is clearly now getting in the way of further progress. While the S&P 500’s forward earnings yield stands at a not unreasonable 5.5%, this is insufficient compensation for the associated volatility given that nearly 4% can be had virtually risk-free from holding US government bonds.

Figure 2: Inflation is slowing, but has a way to go until it’s back to the Fed’s official 2% target

For investors, the interest rate issue therefore remains the chief impediment to declaring a ‘goldilocks economy’ and being able to engage meaningfully in risk assets. The anticipation of such a scenario justifiably propelled stocks from October last year to end of January this year, but low investor participation as observed by ETF and mutual fund flows suggests the rally was poorly attended amid scepticism that the inflation beast really had been slain and rates could safely come back down to pre-2022 levels. For a sustainable goldilocks scenario, both central bank and market-based interest rates will need to come down meaningfully and make stocks look relatively more attractive to capital allocators once again. This will in turn require a faster and more linear pace of disinflation than is currently in evidence, probably with substantial weakness in the labour market too. The jury is still out on whether this will play out so neatly, and inflation is notorious in the academic literature for being hard to accurately predict. Markets have already seen multiple phases in a short period of time since 2020 – working from home, re-opening, inflation and now supposedly goldilocks. The challenge for investors is that by the time one phase has been identified and portfolios adjusted, the next one may already have taken its place. This may be disheartening for those looking to add value over the short term but whatever happens over the next few months, some form of goldilocks scenario seems inherently likely over a much longer horizon. Economic growth is likely to be suppressed in the coming years given the challenging state of demographics and inequality, which in turn should have the effect of keeping inflation and interest rates ‘naturally’ capped. That should be sufficient support for long-dated assets like US equities and bonds to make further progress. In the meantime, investors need to watch out for that interest rate bear.

The information in this document is given for information purposes only and does not qualify as investment advice. Opinions and assessments contained in this document may change and reflect the point of view of GAM in the current economic environment. No liability shall be accepted for the accuracy and completeness of the information. Past performance is no indicator of current or future trends. The mentioned financial instruments are provided for illustrative purposes only and shall not be considered as a direct offering, investment recommendation or investment advice or an invitation to invest in any GAM product or strategy. Reference to a security is not a recommendation to buy or sell that security. The securities listed were selected from the universe of securities covered by the portfolio managers to assist the reader in better understanding the themes presented. The securities included are not necessarily held by any portfolio or represent any recommendations by the portfolio managers.