Julian Howard outlines his latest multi asset views, exploring how a mostly challenging 2022 started to show signs of improvement which he believes are likely to persist into the New Year.

09 January 2023

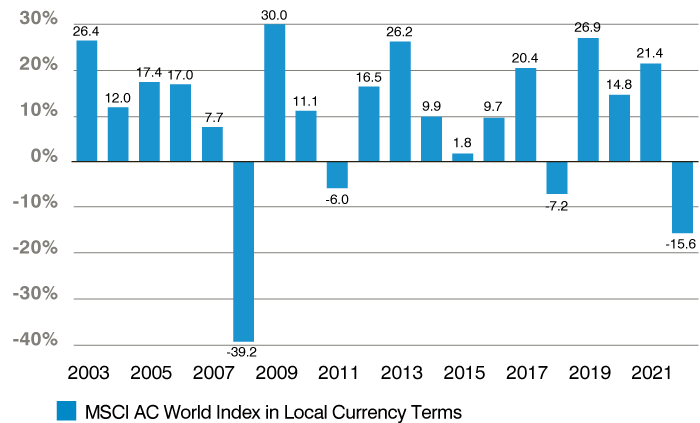

Global equities, as measured by the MSCI AC World Index, fell nearly -16% in local currency terms in 2022, the worst full calendar year since the global financial crisis (GFC) of 2008. The immediate drivers of this decline were high inflation, higher interest rates, war in Ukraine and China’s zero-Covid policy. The inflation component was especially important as the one factor that prevented the US Federal Reserve (Fed) and other central banks around the world from riding to the rescue of the global economy – and therefore investible assets – in the way that they have consistently done since the GFC. The Fed ‘put’ was reluctantly set aside in 2022 as the central bank belatedly attempted to control inflation by tightening monetary policy and, in so doing, slowing down economic activity.

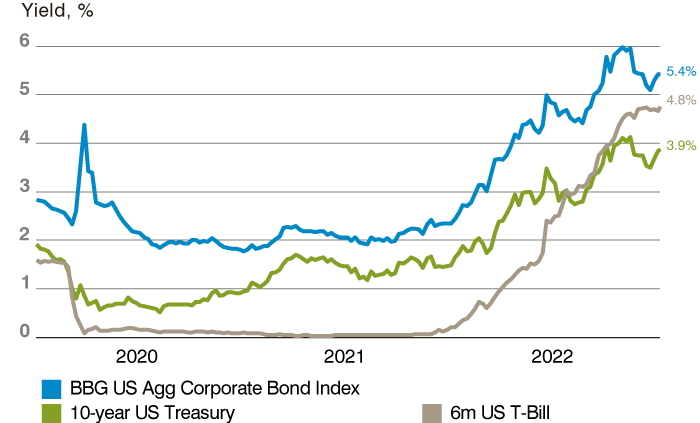

However, to characterise the entirety of 2022 as an unremitting ‘polycrisis’ would be inaccurate. From 12 October to 31 December the MSCI AC World gained nearly 8% as relief came through on three key fronts: US headline inflation decelerated from its June peak of 9.1% to the 7.1% posted in November, with 10-year US Treasury yields – the market gauge of growth and inflation – falling from 4.3% in late October to 3.9% by the end of the year. In Ukraine, Russia’s war strategy was dealt a severe blow by the re-taking of Kherson, giving the Ukrainians the strategic initiative. Finally, China abandoned its zero-Covid strategy under the weight of a widespread popular backlash. Caseloads inevitably spiked but the message was clear: the priority was once again the economy.

Taken together, this allows 2022 to be compartmentalised into a lengthy ‘inflation and rates’ phase book-ended by a period of meaningful reassessment. It is however worth noting that price action during the latter segment, while positive overall, was not one of consistent euphoria. The cryptocurrency meltdown, along with unrealistic expectations of a complete Fed U-turn on rates that did not materialise, meant that investors were relatively guarded in their response. Nonetheless, it was becoming apparent that the relentless onslaught of bad news that had gripped markets was starting to loosen.

Chart 1: MSCI AC World in local currency terms posts worst year since the GFC

Past performance is not an indicator of future performance and current or future trends. Data from 31 Dec 2002 to 31 Dec 2022. For illustrative purposes only.

Chart 2: Why stretch for more? T-Bills offer attractive risk- and maturity-adjusted yields

Past performance is not an indicator of future performance and current or future trends. Data from 31 Dec 2019 to 31 Dec 2022. For illustrative purposes only. Indices cannot be purchased directly.

Our ultra-long term outlook for the global economy and markets remains broadly unchanged. Low growth, and by inference low rates, look set to be driven by continued economic inequality, low productivity, deteriorating demographics, de-globalisation of trading, state expansion and climate change.

However, the short to medium term offers less certainty. While the fundamentals of the good news that lifted the final quarter of 2022 look set to persist into 2023, investment trends rarely play out linearly and the economic backdrop remains challenging as consumers retrench. The OECD recently predicted GDP growth of 2.2% for 2023, down from the 3.1% that seems likely for 2022. Global inflation will suffer pauses and reversals as it decelerates, not least from a likely boost in Chinese energy demand.

Furthermore, market expectations of a Fed pivot are unlikely to be met given the central bank will be acutely conscious of its own credibility as it responds slowly to peaking inflation. This mismatch is likely to explain why indices will probably not spike euphorically on softer inflation data in the coming months, however welcome it may seem to market commentators. Ukraine meanwhile faces a long haul to restoring its territorial integrity, with slow progress and rising costs the main risk to vital continued western commitment. In China, the lifting of Covid restrictions is seeing hospitals overwhelmed and, in the absence of a successful vaccination programme, localised but economically disruptive lockdowns could yet be re-deployed.

More broadly, the FTX scandal could have a temporarily dampening effect on investor enthusiasm. The collapse in bitcoin has been concurrent with outflows from US mutual funds and ETFs in the final quarter of the year, suggesting that investors have been turned off ‘everything’. But, far from being a reason to be despondent, fundamentally better newsflow with limited (initial) investor participation is arguably a formula for improved returns in the medium term. Persistent equity engagement will remain key to capitalising on these better conditions of course, but effective diversification and tactical asset allocation will be important for the inevitable soft patches and unexpected occurrences that await. We approach 2023 therefore a little wiser, but quietly optimistic too.

Source: GAM, unless otherwise stated. The information in this document is given for information purposes only and does not qualify as investment advice. Opinions and assessments contained in this document may change and reflect the point of view of GAM in the current economic environment. No liability shall be accepted for the accuracy and completeness of the information. Past performance is not a reliable indicator of future results or current or future trends. The mentioned financial instruments are provided for illustrative purposes only and shall not be considered as a direct offering, investment recommendation or investment advice. There is no guarantee that forecasts will be realised.