At GAM Investments, our purpose is to protect and enhance our clients’ financial future. As part of this, we are constantly challenging ourselves to think beyond the obvious. In the Thematic Thoughts series, GAM's Sustainable and Thematic Investment Team highlight emerging ideas and themes that they believe could present investment opportunities.

13 July 2023

The challenge we face

With the rise of sustainable investing, the social component is arguably the most difficult to measure and interpret and is the area where we have the most work to do as investors.

Environmental measures such as carbon emissions can be monitored over time and the gold standard for governance practices is set out by various regional and country level codes. But who sets out what is best practice for social standards and at what point does the social risk profile of a country make it a viable investment opportunity?

At a fundamental level, this is primarily driven by bodies such as the International Labour Organisation (ILO) or the Office of the United Nations High Commissioner for Human Rights (OHCHR); but looking beyond this there are a number of structural measures that can provide powerful insights into how future decades may play out from a social perspective.

Why does this matter?

Interpreting social developments is key to understanding the demographic profile and development of a country, as well as subsequent productivity gains and value creation. Although nascent, and remaining mindful of its poor human rights record and rankings on political and civil liberties, we believe there is no better live example of this than the significant social reforms taking place in Saudi Arabia, underpinned by the Vision 2030 plan which aims to reduce oil dependency. Established in 2016, Vision 2030 is a social and economic reform framework and the brainchild of Crown Prince Mohammed bin Salman, the 38-year-old de facto ruler of Saudi Arabia.

A fundamental development to highlight is the introduction of policies required to close the gap towards meeting international standards regarding rule of law, justice and governmental oversight. 2021 saw the introduction of new laws, including a Civil Transactions and Personal Status Law, enabling a path to codified law while adhering to Sharia principles. While this is a step in the right direction, we expect a continuation of new policies and evidence-based action to give businesses the confidence to invest over the long term and to address the concerns of human rights groups. As recently as 2022, Amnesty International reported on mass executions, unfair trials in the Specialised Criminal Court (SCC) and forced evictions taking place in Saudi Arabia.

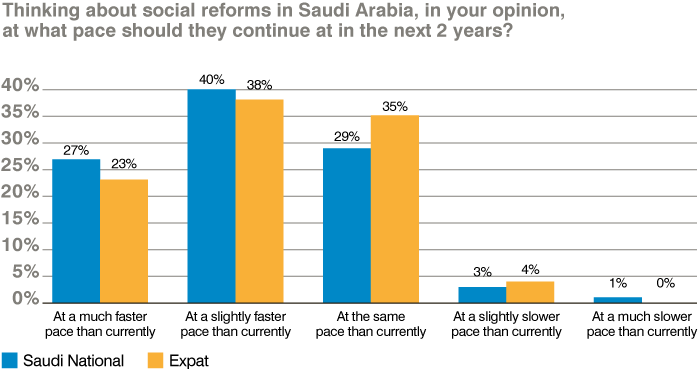

Saudi is undergoing a very public and multi-generational transformation on several fronts resulting in a more open economy. In stark contrast, most developed countries are retreating inward while dealing with the impact of rapidly falling birth rates and shrinking working populations. Research from Morgan Stanley suggests there is currently strong public support for the plan across age groups and genders, although this will require close monitoring throughout the next decade.

Figure 1: Strong public support for social reforms in Saudi Arabia

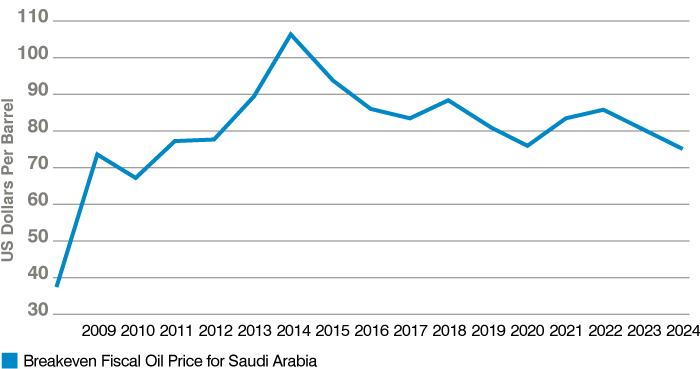

The second key area to highlight is the Saudi Green Initiative which aims to achieve net zero nationally by 2060, while tackling the combined challenges of energy security and driving forward the energy transition. USD 700 billion has been set aside for investment in growing the green economy but the inherent paradox is the country’s windfall oil revenues amounting to USD 326 billion in 2022 alone. Based on IMF estimates, Saudi Arabia’s fiscal breakeven oil price is approximately USD 80 per barrel and is forecast to fall throughout 2023, supporting wider reformation, alongside the powerful OPEC+ pricing lever.

Figure 2: Breakeven fiscal oil price for Saudi Arabia

What is the opportunity from an investment perspective?

Six years into the plan and reflecting on a recent visit to Saudi at the start of the year, the pace of change on the ground is clearly evident. Three key transformations and associated opportunities to highlight include:

- The rise of Saudi women – beginning in 2017 by lifting a ban on female gyms, followed by the removal of a driving ban the following year, 2019 was a transformative year in social reforms for females in Saudi Arabia. The guardianship system, essentially requiring permission from a male guardian to perform activities such as work or international travel, was relaxed and employment discrimination protections were introduced. This has resulted in a rapid increase in female labour force participation from 23% in 2018 to 36% as at Q4 2022, eight years ahead of the 2030 target. What is more telling is that in the core working age segment, 25-54 years, the female participation rate stands at 49% (source: General Authority for Statistics). Key industries we expect to benefit from this prospective increasing pool of disposable income include fitness services/memberships, luxury goods, restaurants and autos.

- Introduction of tourism – foreign tourist visas were initially introduced in September 2019, but there were several social reforms announced in the lead up to this event. A prohibition on entertainment (cinemas and concerts) was lifted in 2017 and the legal requirement for females to wear a headcover and abaya was removed the following year, alongside easing of gender-based social mixing. The Vision 2030 framework estimates a 10% contribution towards GDP by the end of the decade, following in the footsteps of neighbouring UAE. Key beneficiaries are likely to include hotel and lodging, airlines and airport infrastructure, as well as increased demand for domestic leisure activities.

- Improvement momentum – social reforms are closely linked to governance reforms, and the latter is what will primarily drive international investment interest. We recognise there is still a lot of work to do in this respect to deepen capital markets and liquidity. Two World Bank Governance Indicators to bear in mind are Political Stability/Absence of Terrorism and Voice and Accountability, which are starting from a lower base and require significant reformation to translate into meaningful improvement. In 2022 we saw several legal reforms encouraging improvement in indicators such as Rule of Law, Regulatory Quality and Government Effectiveness.

Although poor rankings on political and civil liberties remain a challenge for many investors, we believe Saudi Arabia is currently underrepresented in emerging market indices and portfolios. The above drivers highlight the potential opportunities arising from what could potentially be one of the greatest market reform stories throughout the next decade.

The information contained herein is given for information purposes only and does not qualify as investment advice. Opinions and assessments contained herein may change and reflect the point of view of GAM in the current economic environment. No liability shall be accepted for the accuracy and completeness of the information contained herein. Past performance is no indicator of current or future trends. The mentioned financial instruments are provided for illustrative purposes only and shall not be considered as a direct offering, investment recommendation or investment advice or an invitation to invest in any GAM product or strategy. Reference to a security is not a recommendation to buy or sell that security. The securities listed were selected from the universe of securities covered by the portfolio managers to assist the reader in better understanding the themes presented. The securities included are not necessarily held by any portfolio or represent any recommendations by the portfolio managers. Specific investments described herein do not represent all investment decisions made by the manager. The reader should not assume that investment decisions identified and discussed were or will be profitable. Specific investment advice references provided herein are for illustrative purposes only and are not necessarily representative of investments that will be made in the future. No guarantee or representation is made that investment objectives will be achieved. The value of investments may go down as well as up. Past results are not necessarily indicative of future results. Investors could lose some or all of their investments.

The foregoing views contains forward-looking statements relating to the objectives, opportunities, and the future performance of the U.S. market generally. Forward-looking statements may be identified by the use of such words as; “believe,” “expect,” “anticipate,” “should,” “planned,” “estimated,” “potential” and other similar terms. Examples of forward-looking statements include, but are not limited to, estimates with respect to financial condition, results of operations, and success or lack of success of any particular investment strategy. All are subject to various factors, including, but not limited to general and local economic conditions, changing levels of competition within certain industries and markets, changes in interest rates, changes in legislation or regulation, and other economic, competitive, governmental, regulatory and technological factors affecting a portfolio’s operations that could cause actual results to differ materially from projected results. Such statements are forward-looking in nature and involve a number of known and unknown risks, uncertainties and other factors, and accordingly, actual results may differ materially from those reflected or contemplated in such forward-looking statements. Prospective investors are cautioned not to place undue reliance on any forward-looking statements or examples. None of GAM or any of its affiliates or principals nor any other individual or entity assumes any obligation to update any forward-looking statements as a result of new information, subsequent events or any other circumstances. All statements made herein speak only as of the date that they were made.