Emerging Market Debt – Looking at yields, and the biggest driver – inflation and policy rates – gives us grounds for optimism

December 2023

Challenges and opportunities: Click here to read GAM's investment managers' Outlooks for 2024

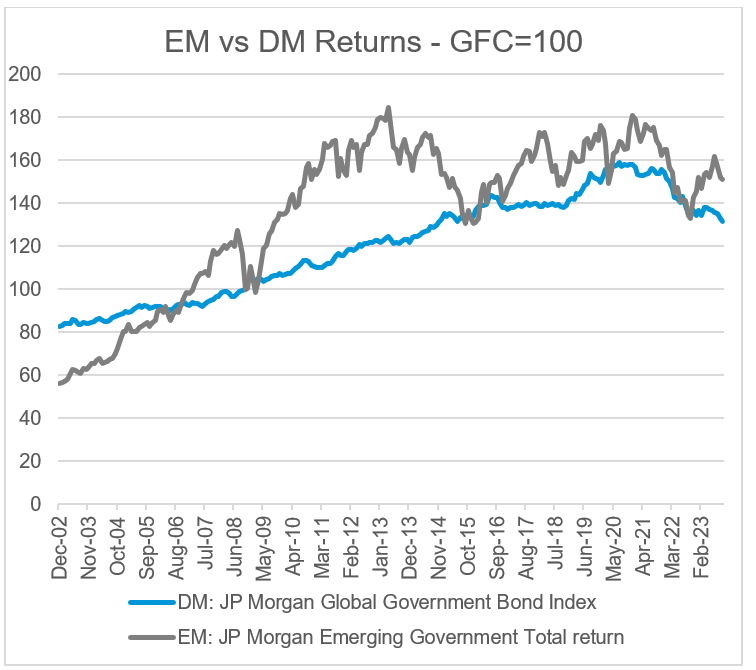

After a dire year amid rising interest rates in 2022, emerging market (EM) bonds in both local and hard currency did well in 2023. At the time of writing, both asset classes had outperformed US developed market (DM) government bonds, US Treasuries (which admittedly had a poor year) and investment-grade corporate credit; local currency debt also outperformed US high yield, despite an indifferent year for the dollar.

Grounds for optimism

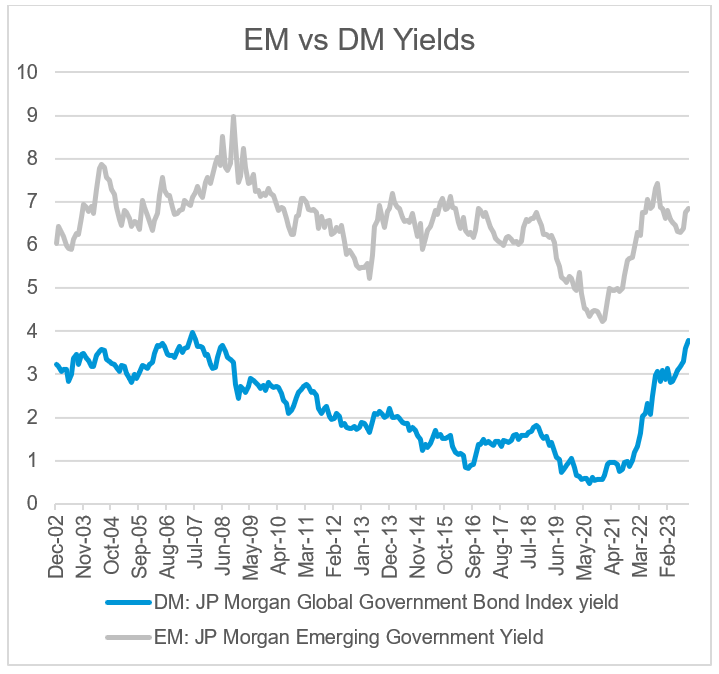

Across the two calendar years of global rate hikes, EM has performed solidly. A rally late in 2022 (when DM rates continued to rise) meant that EM rates rose less than DM rates over the course of 2022. Outperformance was even more notable in 2023 – by November, EM rates were over 1% lower than their peak a year earlier. DM yields did not peak until October 2023 and are only 25 bps off this peak as we write.

Looking at yields, and the biggest driver – inflation and policy rates – gives us grounds for optimism. Most of our optimistic views for 2023 were vindicated – lower food and energy prices had a bigger impact in EM, where commodities play a larger role in consumption and services play a smaller part in economic activity. Inflation fell quickly and central banks responded – generally more cautiously than their DM counterparts but through 2023, even hawkish institutions like the central banks of Chile and Brazil had embarked on cutting cycles. Looking across the EM world we continue to see plenty of value. Several EM countries are showing forward-looking real yields much higher than longer-term averages, even allowing for further disinflation. We find Mexico especially attractive here.

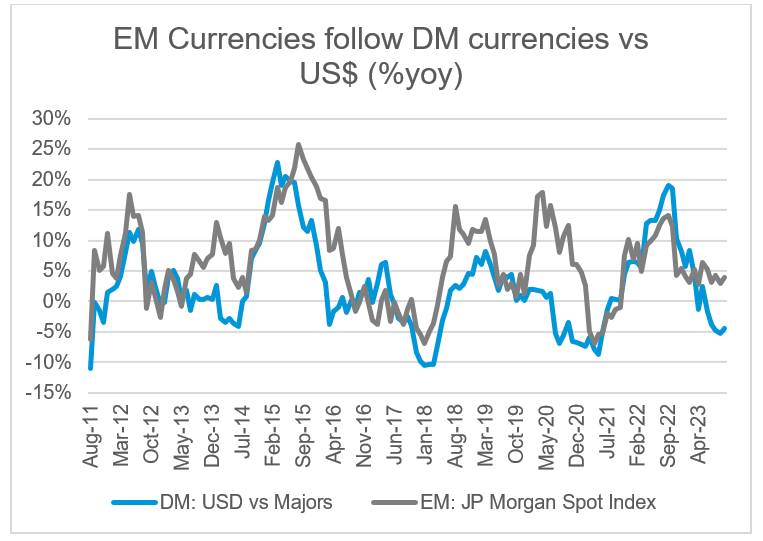

This rosy rate picture leaves us with two concerns: first, while EM currencies have done enough to leave EM returns very comfortable compared with non-US DM, dollar returns have been at the mercy of dollar strength; second, bond markets in DM are clearly straining at the prospect of unprecedented net supply, as quantitative tightening coincides with the prospect of dramatically looser fiscal policy globally.

The issue for local currency EM continues to be the extent to which global growth is US centric. In this environment, the dollar is almost inevitably strong, especially now that the US is once again not a significant oil importer (due to fracking). Since the Global Financial Crisis (GFC), the dollar has risen in 10 out of 14 years, and the pre-crisis outperformance of local currency EM debt vs USD EM debt has reversed.

One positive: we see scope for stronger Chinese growth – which traditionally lifts especially the currencies of commodity exporters, but it is harder to be sanguine about Europe. Tight fiscal policy and institutional rigidities continue to weigh on growth in the region. There is also the ongoing threat of the cut-off of Russian gas sales. While last winter demonstrated that Europe can cope as long as the winter is mild, the large increase of gas usage if winter is less benign leaves the continent at risk.

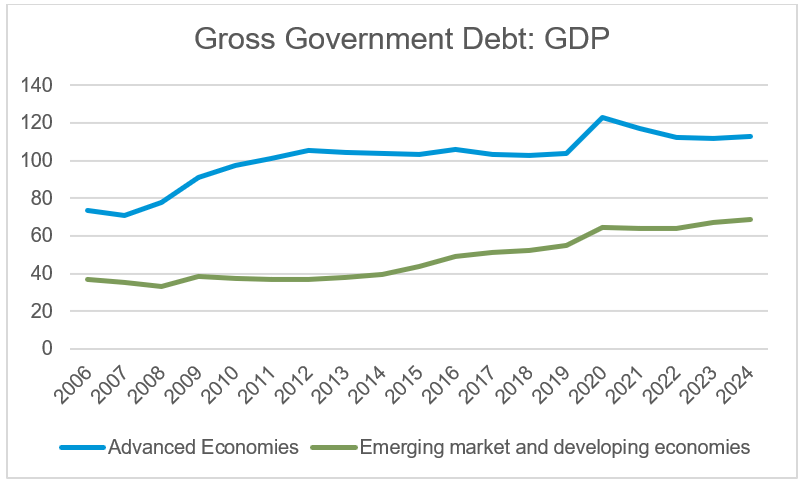

Rising global government debt

The rising global government debt story should, on the face of it, be a positive for EM. Government debt – net or gross – in EM is generally much lower than in DM and has risen less since the GFC (including during the Covid pandemic). We are uncomfortable with this glib narrative for a number of reasons: a rising term premium seems unlikely to restrict itself to DM; real yields remain higher in EM and institutions weaker, so financeable levels of government debt will be lower; and the countries with the lowest debt are inevitably not the large issuers where market exposure is. We see scope for some outperformance but see material risks to a fundamentally benign outlook for EM rates.

The story for hard currency bonds – sovereign debt from EMs issued in DM currencies – was, as usual, very similar to that for corporate credits of similar ratings issued in the same currencies. As befits a strong year for risk assets, the lowest-rated credits performed best in 2023, with distressed countries like Ukraine, Sri Lanka, Pakistan and Venezuela returning over 40% (159% in the last case). Here the outlook for 2024 is simpler – absent a recession, or a slowdown sufficient to have recession-like impact, the very high yields should produce strong returns, with the weakest part of the credit stack performing best, although unlikely to be quite as outstanding as in 2023.

The information contained herein is given for information purposes only and does not qualify as investment advice. Opinions and assessments contained herein may change and reflect the point of view of GAM in the current economic environment. No liability shall be accepted for the accuracy and completeness of the information contained herein. Past performance is no indicator of current or future trends. The mentioned financial instruments are provided for illustrative purposes only and shall not be considered as a direct offering, investment recommendation or investment advice or an invitation to invest in any GAM product or strategy. Reference to a security is not a recommendation to buy or sell that security. The securities listed were selected from the universe of securities covered by the portfolio managers to assist the reader in better understanding the themes presented. The securities included are not necessarily held by any portfolio nor represent any recommendations by the portfolio managers nor a guarantee that objectives will be realized.

This material contains forward-looking statements relating to the objectives, opportunities, and the future performance of the U.S. market generally. Forward-looking statements may be identified by the use of such words as; “believe,” “expect,” “anticipate,” “should,” “planned,” “estimated,” “potential” and other similar terms. Examples of forward-looking statements include, but are not limited to, estimates with respect to financial condition, results of operations, and success or lack of success of any particular investment strategy. All are subject to various factors, including, but not limited to general and local economic conditions, changing levels of competition within certain industries and markets, changes in interest rates, changes in legislation or regulation, and other economic, competitive, governmental, regulatory and technological factors affecting a portfolio’s operations that could cause actual results to differ materially from projected results. Such statements are forward-looking in nature and involve a number of known and unknown risks, uncertainties and other factors, and accordingly, actual results may differ materially from those reflected or contemplated in such forward-looking statements. Prospective investors are cautioned not to place undue reliance on any forward-looking statements or examples. None of GAM or any of its affiliates or principals nor any other individual or entity assumes any obligation to update any forward-looking statements as a result of new information, subsequent events or any other circumstances. All statements made herein speak only as of the date that they were made.