17 February 2022

Ad hoc announcement pursuant to Art. 53 listing rules: GAM Holding AG announces full-year 2021 results

Financial Highlights

- Group assets under management (AuM) were CHF 100 billion as at 31 December 2021 (compared with CHF 122 billion as at 31 December 2020)

- Investment Management saw net client outflows of CHF 4.4 billion, with Fund Management Services (formerly private labelling) recording net client outflows of CHF 20.5 billion primarily due to one large client departure previously announced

- Continued strong investment performance from equities and strong recovery in fixed income; 68% and 60% of investment management AuM outperformed their benchmark over three and five years, respectively

- Cost discipline continues to deliver to plan; achieved cost saving target of CHF 15.5 million

- Underlying loss before tax of CHF 9.6 million (compared with underlying loss of CHF 14.9 million in FY 2020)

- IFRS net loss of CHF 23.3 million (compared with a net loss of CHF 388.4 million in FY 2020)

- Financial targets for 2024 revised to reflect current levels of AuM

Strategic progress

- One technology platform now in operation across all equity portfolios and most fixed income portfolios enabling a scalable future

- Distribution strategy successfully diversifying client interest across asset classes, with net positive client flows into equities for five consecutive quarters

- Refocused distribution footprint to align with evolving client demand

- Continuing to attract and retain talent; stable and high calibre bench of investment and client facing professionals

- Aligning to client demand with product innovation and focus on sustainability

- New leadership for Fund Management Services in Luxembourg

- Increased focus on Wealth Management with appointment of new leadership

- All historic regulatory matters now resolved

- Returned 100% of client investment in the supply chain finance fund

Peter Sanderson, Group CEO, said: “2021 was a pivotal year of strategic progress for GAM, which has put us in a good position to focus on delivering value to our stakeholders through bringing GAM to growth. In the new post-pandemic paradigm, we are seeing an increased appetite for actively managed alternative, sustainable and high-conviction strategies and solutions from our existing and potential clients, which plays to our strengths as a firm.”

2021 Group results

Net fee and commission income decreased by 2.5% to CHF 227.3 million compared with CHF 233.2 million in FY 2020. This decrease was primarily driven by lower net management fees and commissions because of the lower average AuM and a slightly lower average management fee margin in Investment Management. This is offset by an increase to CHF 19.3 million from CHF 2.8 million in net underlying performance fees. The main contributors were GAM Star Disruptive Growth, our core macro as well as our non-directional equity strategies. IFRS net fee and commission income amount to CHF 229.5 million. The difference between the underlying and the IFRS net fee and commission income of CHF 2.2 million relates to performance fees attributed to external interests1.

Underlying personnel expenses decreased by 5.0% to CHF 143.1 million in FY 2021 from CHF 150.5 million in FY 2020. Variable compensation came in at CHF 38.3 million and was 19% higher compared to 2020, mainly driven by increased performance fee bonuses. Fixed personnel costs were CHF 104.8 million, a decrease of 11%, mainly driven by lower headcount which stood at 605 FTEs, as at 31 December 2021, compared with 701 FTEs at the end of 2020. This compares to IFRS personnel expenses of CHF 144.4 million. The difference between the underlying and the IFRS personnel expenses of CHF 1.3 million mainly relates to a reorganisation charge of CHF 1.3 million1.

Underlying general expenses totalled CHF 73.2 million, a decrease of 2% compared with CHF 75.0 in FY 2020. This was driven by lower marketing and administration costs. This compares to IFRS general expenses of CHF 86.7 million. The difference between the underlying and the IFRS general expenses of CHF 13.5 million mainly relates to a fine agreed between GAM International Management Limited (GIML) and the UK Financial Conduct Authority (FCA) of CHF 11.3 million1.

The underlying operating margin stood at negative 3.2%, compared with negative 4.7% in FY 2020. The improvement was driven mainly by operating leverage as expenses decreased by 4%, outweighing the reduction in income of 2%. This compares to an IFRS operating margin of negative 9.6%. The difference between the underlying and the IFRS operating margin mainly relates to higher IFRS expenses of CHF 251.6 million compared to underlying expenses of CHF 234.51.

The underlying loss before taxes was CHF 9.6 million in FY 2021, compared to a CHF 14.9 million underlying loss before tax in FY 2020. The reduced loss was driven mainly by lower fixed and general expenses offsetting the decrease in AuM resulting in lower net fee and commission income. This compares to an IFRS net loss before tax of CHF 15.2 million. The difference between the underlying and the IFRS net loss before tax of CHF 5.6 million mainly relates to higher IFRS net fee and commission income and higher IFRS other income. This is more than offset by higher IFRS expenses1.

The underlying effective tax rate for 2021 was 21.9% compared with 0.0% in 2020. The increase in the effective tax rate was primarily driven by a tax credit from an increase in deferred tax assets based on higher future UK corporation tax rates. This compares to an IFRS tax rate of negative 53.3%. The difference between the underlying and the IFRS effective tax rate mainly relates to an adjustment of deferred tax assets of CHF 10.7 million based on the re-assessment of the future recoverability of tax losses carried forward1.

Diluted underlying earnings per share were negative CHF 0.05, up from negative CHF 0.10 in 2020 and resulting from the underlying net loss. This compares to a diluted IFRS earnings per share of negative CHF 0.15. The difference between the diluted underlying and the diluted IFRS earnings per share of CHF 0.10, mainly relates to the higher IFRS net loss of CHF 23.3 million compared to an underlying net loss of CHF 7.5 million1.

The IFRS net loss after tax was CHF 23.3 million, mainly driven by the underlying net loss after tax of CHF 7.5 million and non-core items of CHF 24.0 million that included a fine agreed between GIML and the FCA of CHF 11.3 million and a CHF 10.7 million adjustment relating to a re-assessment of the future recoverability of tax losses carried forward. These were partially offset by after-tax acquisition-related income of CHF 8.2 million. This compares to an IFRS net loss after tax of CHF 388.4 million in FY 2020 which was mainly impacted by the impairment of legacy goodwill of CHF 373.7 million.

Business Update

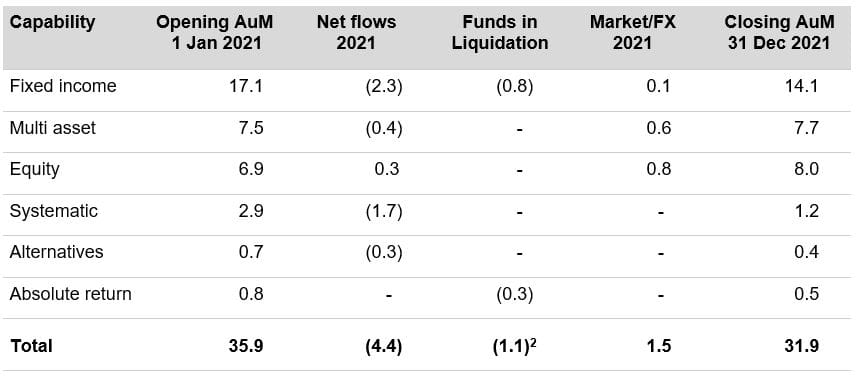

Assets under management movements (CHF bn)

AuM totalled CHF 31.9 billion as at 31 December 2021, down from CHF 35.9 billion at year-end 2020, primarily driven by net outflows of CHF 4.4 billion and CHF 1.1 billion of funds in liquidation, helped by net positive market and foreign exchange movements of CHF 1.5 billion.

Net flows by capability

In fixed income, net outflows totalled CHF 2.3 billion, primarily driven by the GAM Local Emerging Bond and GAM Star Credit Opportunities, which were only slightly offset by inflows into the GAM Star Cat Bond fund.

Multi asset strategies experienced net outflows of CHF 0.4 billion in 2021, driven by redemptions primarily from institutional and private clients.

In equity, GAM saw net inflows of CHF 0.3 billion primarily driven by the GAM Star Disruptive Growth, GAM Star Continental European Equity and GAM Luxury Brands Equity funds which exceeded withdrawals primarily from the GAM Emerging Markets Equity and GAM Health Innovation funds.

In systematic, net outflows of CHF 1.7 billion were driven by redemptions from the GAM Systematic Alternative Risk Premia and GAM Systematic Core Macro funds.

In alternatives, GAM saw net outflows of CHF 0.3 billion, driven by redemptions from one client.

Absolute return was overall net flat in respect of client flows, while CHF 0.3 billion of absolute return assets are in liquidation following the realignment of our Lugano capabilities.

Investment performance

Over the three-year period to 31 December 2021, 68% of AuM in funds outperformed their respective benchmark compared with 23% as at 31 December 2020. This improvement was primarily driven by a strong recovery in fixed income investment performance and continued strong performance from our equities strategies, with many in the top quartile across time periods. Over the five-year period to 31 December 2021, 60% of AuM in funds outperformed their respective benchmark, down from 70% as at 31 December 2020. With respect to GAM’s AuM tracked by Morningstar, 70% and 62% of outperformed their peer groups over three and five-year periods as at 31 December 2021, respectively.3

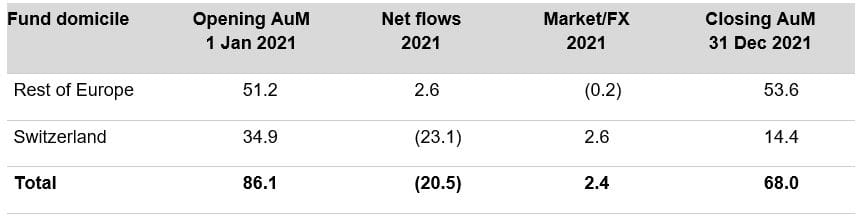

Assets under management movements (CHF bn)

Assets under management were CHF 68.0 billion as at 31 December 2021, down from CHF 86.1 billion in 2020. This was driven by net outflows of CHF 20.5 billion, primarily due to one client’s decision to transfer their business to another provider as a part of a broader strategic relationship with that entity, partially offset by positive market performance of CHF 3.9 billion, and negative foreign exchange movements of CHF 1.5 billion.

In 2021, we announced an increased focus on Wealth Management under new leadership.

We currently report the assets within our Investment Management business, but as at 31 December 2021, GAM Wealth Management reported AuM of CHF 2.9 billion. Our clients are mainly located in the UK, Switzerland and Asia.

Strategy Update

Strong investment performance, good client momentum and increased diversification

- Strong recovery in fixed income investment performance and continued strong performance in equities, with many strategies in the top quartile across time periods

- Net positive inflows into equities in each quarter in 2021

- More diversified pipeline across investment capabilities, reducing concentration risk

- Ongoing positive conversations with longstanding and potential new clients

- Deeper understanding of our clients’ needs and objectives and ability to offer investment capabilities and solutions that meet their investment goals: an example is our recently announced strategic partnership with Liberty Street Advisors to provide clients with access to late stage, privately-owned high-growth innovation companies

- Enhanced digitisation in client engagement

Distribution footprint refocused to align with evolving client demand

- Strengthened presence in Asia, a strategic growth market for GAM, with new hires and the opening of our Singapore office

- Reinforced institutional team with new hires in the USA and Switzerland, along with a new Global Head of Consultant Relations

Strong progress with our sustainability strategy

- New Global Head of Sustainable and Impact Investment and new hires in our sustainability team

- Successful launch of sustainable local emerging bond and sustainable climate bond strategies and development underway on a range of sustainable thematic equity funds

- Improved sustainable investment framework with the introduction of a proprietary ESG dashboard

- Proprietary ESG, climate and impact assessment framework to be rolled out in 2022

- Introduced a sustainability exclusion policy

- Listed as signatory to the UK Stewardship Code, certified as CarbonNeutral® company for operational emissions, joined the Net Zero Asset Managers initiative, committing to supporting investing aligned with the goal of net zero by 2050 or sooner

Appointed new Global Head of Fund Management Services and CEO of Luxembourg

- Focused on revenue growth using the full suite of GAM capabilities in response to client demand for an enhanced offering

Increased focus on Wealth Management to drive growth from our existing base of private clients

GAM ranked best Swiss-listed financial services provider in Inrate’s Corporate Governance zRating for the third consecutive year

Launch of ESG client reports for more than two-thirds of GAM funds

Continued to strengthen our policies and disclosure

- Published first ever standalone Sustainability Report, enhanced Stewardship Report and first disclosure on our management of climate risk using the TCFD (Taskforce on Climate-related Financial Disclosure) framework

Reached settlement with UK Financial Conduct Authority in December 2021, bringing the investigation into the Absolute Return Bond Fund matter to a close

Closed the supply chain finance fund, marking the end of GAM’s legacy business relationship with Greensill

- Returned over 100% of value of the GAM Greensill Supply Chain Finance fund to clients

Delivered cost reduction target

- CHF 15.5 million of savings in fixed personnel and general expenses

- Since 2018, reduced total expenses from CHF 373.5 million to CHF 234.5 million, down 37%

- Continuing to drive efficiency gains to assist meeting our revised financial targets

Investment in new operating platform completed

- One technology platform now in operation across all equity portfolios, most fixed income portfolios and delivering excellence across ‘One GAM’. Wealth Management now supported by a new client administration platform, agile technology successfully rolled out across the firm to facilitate a hybrid way of working, enhanced collaboration with a flexible approach to doing business and reduced office space

- Implementation of Workday, our new Finance and HR operating platform, completed with legacy systems decommissioned

Implementation of operational changes

- Strengthened high performing global equity team

- Realignment of systematic capabilities to focus on GAM Systemic Alternative Risk Premia and GAM Systematic Core Macro

- Closure of some long-short strategies to align with client demand

Further simplification of firm’s legal structure

- Continued to merge legal entities to create a simplified branch structure

Liquidity and capital management

Cash and cash equivalents at the end of 2021 amounted to CHF 234.8 million, down from CHF 270.9 million one year earlier, reflecting mainly changes in accrued distribution fees and third party payments, as well as compensation-related share-repurchases, acquisition-related deferred consideration and investment into the GAM platform.

Adjusted tangible equity at the end of 2021 was CHF 174.2 million, compared with CHF 188.7 million a year earlier. The main contributors to this decrease were the IFRS net loss after tax of CHF 23.3 million and investment in developed software of CHF 18.0 million, partially offset by a pension remeasurement of CHF 32.2 million.

Recognising GAM’s underlying loss in 2021, the Board of Directors proposes to shareholders that, in line with our long-term dividend policy, no dividend will be paid for the financial year 2021. The Board of Directors continues to target a minimum dividend pay-out of 50% of underlying net profit to shareholders.

The compensation framework for our Group Management Board (GMB) members drives their remuneration through clear goals aligned to our shareholders’ expectations. Although the Board recognises the significant continuing progress against those goals and the Group’s strategic priorities, based on the Group’s financial performance for 2021 there will be no variable compensation for a third successive year proposed for granting to the GMB. This decision was made in full recognition of the GMB’s unwavering commitment, but the financial underperformance continues to make it appropriate that neither annual bonus nor long-term incentive (LTIP) awards are made.

Outlook

We have revisited our financial targets and given current assets under management, we now target an underlying pre-tax profit of at least CHF 50 million, an underlying operating margin of between 20% and 30% and a compensation ratio of 45-50% by full year 2024.

GAM is well positioned to help clients navigate the new paradigm that is emerging from the pandemic. We expect the market environment to remain volatile, but client demand for actively managed alternative, sustainable and high-conviction strategies and solutions, to be strong. GAM is focused on growth and delivering excellence for clients.

The presentation for analysts and investors on the results of GAM Holding AG for 2022 will be webcast on 17 February 2022 at 8:30am (CET). A presentation for media will be webcast at 10:00am (CET). Materials relating to the results (presentation slides, 2021 Annual Report and press release) are available at www.gam.com.

2Funds in liquidation include CHF 0.8 billion of GAM Greensill Supply Chain Finance Fund SCSp, the liquidation of which was announced on 2 March 2021, as well as some long-short strategies of CHF 0.3 billion, as announced on 23 September 2021.

3The peer group comparison is based on ‘industry-standard’ Morningstar Direct Sector Classification. The share class references in Morningstar have been set to capture the oldest institutional accumulation share class for each and every fund in a given peer group.

| 20 April 2022 | Q1 2022 Interim management statement |

| 28 April 2022 | Annual General Meeting 2022 |

| 3 August 2022 | Half-year results 2022 |

| 20 October 2022 | Q3 2022 Interim management statement |

| Charles Naylor Global Head of Communications and Investor Relations T +44 20 7917 2241 |

|

| Media Relations Ute Dehn Christen T+41 58 426 31 36 |

Media Relations Kathryn Jacques T +44 20 7393 8699 |

| Investor Relations Jessica Grassi T +41 58 426 31 37 |

|

Visit us at: www.gam.com

Follow us on: Twitter, LinkedIn

About GAM

GAM is a leading independent, pure-play asset manager. The company provides active investment solutions and products for institutions, financial intermediaries and private investors through three businesses: Investment Management, Fund Management Services and Wealth Management. GAM employed 605 FTEs in 14 countries with investment centres in London, Cambridge, Zurich, Hong Kong, New York, Milan and Lugano as at 31 December 2021. The investment managers are supported by an extensive global distribution network. Headquartered in Zurich, GAM is listed on the SIX Swiss Exchange with the symbol ‘GAM’. The Group has AuM of CHF 100 billion (USD 109.4 billion) as at 31 December 2021.

Disclaimer regarding our financial result

To ensure reader-friendliness, we are commenting on underlying Group KPIs and on the most relevant IFRS figures.

Disclaimer regarding forward-looking statements

This press release by GAM Holding AG (‘the Company’) includes forward-looking statements that reflect the Company’s intentions, beliefs or current expectations and projections about the Company’s future results of operations, financial condition, liquidity, performance, prospects, strategies, opportunities and the industry in which it operates. Forward-looking statements involve all matters that are not historical facts. The Company has tried to identify those forward-looking statements by using words such as ‘may’, ‘will’, ‘would’, ‘should’, ‘expect’, ‘intend’, ‘estimate’, ‘anticipate’, ‘project’, ‘believe’, ‘seek’, ‘plan’, ‘predict’, ‘continue’ and similar expressions. Such statements are made on the basis of assumptions and expectations which, although the Company believes them to be reasonable at this time, may prove to be erroneous.

These forward-looking statements are subject to risks, uncertainties, assumptions and other factors that could cause the Company’s actual results of operations, financial condition, liquidity, performance, prospects or opportunities, as well as those of the markets it serves or intends to serve, to differ materially from those expressed in, or suggested by, these forward-looking statements. Important factors that could cause those differences include, but are not limited to: changing business or other market conditions, legislative, fiscal and regulatory developments, general economic conditions, and the Company’s ability to respond to trends in the financial services industry. Additional factors could cause actual results, performance or achievements to differ materially. The Company expressly disclaims any obligation or undertaking to release any update of, or revisions to, any forward-looking statements in this press release and any change in the Company’s expectations or any change in events, conditions or circumstances on which these forward-looking statements are based, except as required by applicable law or regulation.