20 October 2022

Ad hoc announcement pursuant to art. 53 listing rules: GAM Holding AG releases interim statement for the three-month period to 30 September 2022

Financial highlights

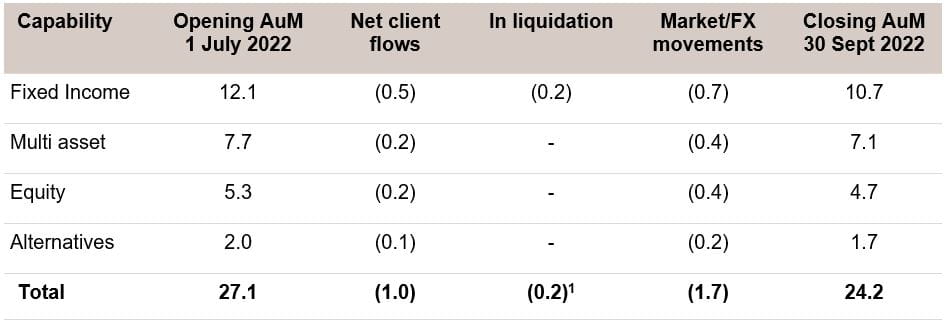

- Investment Management assets under management (AuM) at CHF 24.2 billion, with net client outflows of CHF 1.0 billion and net negative market and foreign exchange (FX) movements of CHF 1.7 billion

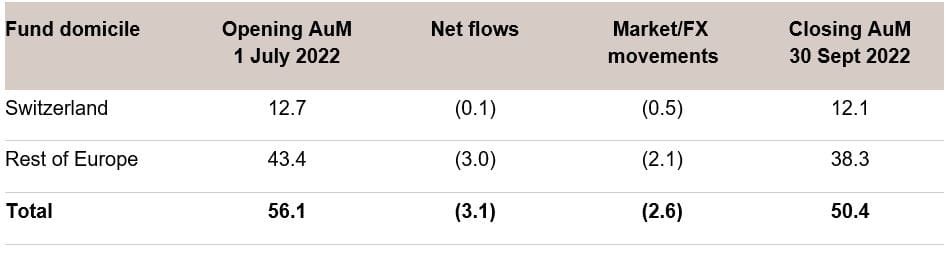

- Fund Management Services AuM at CHF 50.4 billion, with net client outflows of CHF 3.1 billion, and net negative market and FX movements of CHF 2.6 billion

- Strong Investment performance: 74% of AuM outperforming their benchmark over 3 years as at 30 September 2022, compared to 73% as at 30 June 2022

Strategic highlights during third quarter 2022

- Challenging market conditions continue to impact GAM’s assets under management

- On track to deliver reduction in total expenses of at least CHF 20 million for the full year 2022 compared to the full year 2021

- Signatory of UK Stewardship code for second year, announced Net Zero targets covering more than a third of AuM in Investment Management; and recognition by Inrate as 4th best Swiss listed Financial Services provider for corporate governance

Peter Sanderson, CEO GAM Investments said: “The market continued to be very challenging during the third quarter, and clients have remained cautious. Given the negative impact on our assets under management, we are robustly managing our costs and continuing to align our investment strategies to meet client needs. Supporting our clients has never been more important and I am pleased that we continue to deliver strong investment performance, bold thought leadership and excellent client service.”

David Jacob, Chairman, said: “Despite the most challenging market backdrop seen in years, it is pleasing to see the continuing strength in our investment performance and the good progress we have made to simplify our business. Nevertheless, we are constantly reviewing the progress of the firm, and we are committed to ensuring that our strategy is appropriate and in the interests of all our stakeholders”.

As of 30 September 2022, Group AuM totalled CHF 74.6 billion down from CHF 83.2 billion as of the end of June 2022.

Investment management

AuM totalled CHF 24.2 billion, down from CHF 27.1 billion compared to 30 June 2022, with net client outflows of CHF 1.0 billion, and net negative market and foreign exchange movements of CHF 1.7 billion.

Net flows by capability

In fixed income, we recorded net outflows of CHF 0.5 billion, primarily driven by asset allocation decisions by clients in the GAM Star Credit Opportunities and the GAM Star MBS Total Return funds.

Our multi asset strategies saw outflows of CHF 0.2 billion.

In equities, we saw inflows into the GAM UK Equity Income and GAM China Evolution Equity funds, but these were offset by outflows from GAM Emerging Markets Equity, GAM Star Disruptive Growth and GAM Star Continental European Equity funds leading to net outflows of CHF 0.2 billion.

In alternatives, inflows into GAM Star Global Rates and Private Shares were offset by outflows from our GAM Commodity and GAM Systematic Core Macro funds resulting in net outflows of CHF 0.1 billion.

Assets under management movements (CHF bn)

Investment performance

Over the three-year period to 30 September 2022, 74% of AuM in funds outperformed their respective benchmark, compared with 73% as at 30 June 2022.

Over the five-year period to 30 September 2022, 59% of AuM in funds outperformed their respective benchmark, compared with 40% as at 30 June 2022.

Of GAM’s AuM tracked by Morningstar, 78% and 61% outperformed their respective peer groups over the three- and five-year periods to 30 September 2022, respectively, compared with 69% and 58% as at 30 June 2022.

Fund Management Services

Our Fund Management Services business reported AuM of CHF 50.4 billion, down compared to CHF 56.1 billion as of 30 June 2022.

Assets under management movements (CHF bn)

- We expect the market environment to remain challenging, and clients cautious

- We are focused on delivering for our clients with our high-conviction, actively managed strategies and solutions

- We are managing the firm to ensure that we deliver the targeted reduction in total expenses of at least CHF 20 million for the full year 2022

| 28 February 2023 | Full year results 2022 |

| 20 April 2023 | Q1 2023 Interim management statement |

| Charles Naylor Head of Communications and Investor Relations T +44 7890 386 699 |

|

| Media Relations Ute Dehn Christen T+41 58 426 31 36 |

|

Visit us at: www.gam.com

Follow us on: Twitter, LinkedIn

About GAM

We are an active, independent global asset manager that thinks beyond the obvious to deliver distinctive and differentiated investment solutions for our clients across our three core businesses: Investment Management, Wealth Management and Fund Management Services.

Our purpose is to protect and enhance our clients’ financial future. We attract and empower the brightest minds to provide investment leadership, innovation and a positive impact on society and the environment.

Servicing institutions, financial intermediaries, and private investors, we manage CHF 74.6 billion of assets as of 30 September 2022.

Headquartered in Zurich, GAM Investments is listed on the SIX Swiss Exchange with the symbol ‘GAM’ and we employ 594 people across 14 countries with investment centres in London, Cambridge, Zurich, Hong Kong, New York and Milan, as at 30 June 2022. Our operational centres are in Dublin, Luxembourg and London.

Disclaimer regarding forward-looking statements

This press release by GAM Holding AG (‘the Company’) includes forward-looking statements that reflect the Company’s intentions, beliefs or current expectations and projections about the Company’s future results of operations, financial condition, liquidity, performance, prospects, strategies, opportunities and the industry in which it operates. Forward-looking statements involve all matters that are not historical facts. The Company has tried to identify those forward-looking statements by using words such as ‘may’, ‘will’, ‘would’, ‘should’, ‘expect’, ‘intend’, ‘estimate’, ‘anticipate’, ‘project’, ‘believe’, ‘seek’, ‘plan’, ‘predict’, ‘continue’ and similar expressions. Such statements are made on the basis of assumptions and expectations which, although the Company believes them to be reasonable at this time, may prove to be erroneous.

These forward-looking statements are subject to risks, uncertainties, assumptions and other factors that could cause the Company’s actual results of operations, financial condition, liquidity, performance, prospects or opportunities, as well as those of the markets it serves or intends to serve, to differ materially from those expressed in, or suggested by, these forward-looking statements. Important factors that could cause those differences include, but are not limited to: changing business or other market conditions, legislative, fiscal and regulatory developments, general economic conditions, and the Company’s ability to respond to trends in the financial services industry. Additional factors could cause actual results, performance or achievements to differ materially. The Company expressly disclaims any obligation or undertaking to release any update of, or revisions to, any forward-looking statements in this press release and any change in the Company’s expectations or any change in events, conditions or circumstances on which these forward-looking statements are based, except as required by applicable law or regulation.