20 February 2020

GAM Holding AG announces full-year 2019 results and strategy

2019 Highlights

- Underlying profit before taxes of CHF 10.5 million in 2019, down from CHF 126.7 million in 2018; diluted underlying EPS of CHF 0.03 in 2019, a decrease from CHF 0.63 in 2018

- IFRS net loss of CHF 3.5 million, compared with an IFRS net loss of CHF 916.8 million in 2018

- Strong investment outperformance: in 2019, 78% of investment management assets under management (AuM) outperformed their benchmark over 5 years, and 74% over 3 years (up from 63% and 66% in 2018)

- Investment management AuM of CHF 48.4 billion1, down from CHF 56.1 billion2 by end-2018

- Record AuM in Private Labelling of CHF 84.3 billion as at 31 December 2019, up 11% from

CHF 76.1 billion by end-2018 - 2019 cost savings above target: exit run rate savings of CHF 42 million

- Group Management Board (GMB) will receive no bonus for 2019 and CEO Pete Sanderson has

requested to forego a contractual fixed cash award due this year - Board of Directors (BoD) will propose no dividend for the financial year 2019

Group CEO Peter Sanderson announces strategy to make GAM fit for the future

The strategy is based on three pillars: efficiency, transparency and growth with clear financial targets, to be achieved for full-year 2022, subject to market conditions:

Efficiency: realign GAM’s cost base and improve the client experience: incremental cost savings (compared with 2019 exit run rate) of CHF 40 million (CHF 30 million by end-2020 and another CHF 10 million by end-2021), resulting in total savings in excess of CHF 80 million and helping to achieve a 30% operating margin

Transparency: increase clarity, including recognition of the benefits that the Private Labelling business creates for stakeholders and accountability, including better aligning GAM with its stakeholders; a compensation ratio in line with the previous target of 45-50%

Growth: build on GAM’s core strengths to attract and retain the best talent, incentivised over the longterm, to grow the business and drive sustainable AuM inflows; underlying pre-tax profit of CHF 100 million

Peter Sanderson, Group CEO, said: “GAM is a strong business delivering excellent investment performance for clients. This performance is testament to the talent of our people and their ability to help clients actively navigate uncertain market conditions.

The strategy we are outlining today will build long-term shareholder value by complementing this strong investment performance with a more efficient ‘One GAM’ approach, taking full advantage of technology to deliver for our clients. We will become more transparent and have set clear targets against which we will be measured. There are clear avenues to growth by building on our core strengths in client service and differentiated products.”

David Jacob, Chairman of GAM, said: “GAM is now in a solid position and we can look forward to returning to growth and providing the long-term returns our shareholders expect from us. Following a thorough strategic review, the Board has decided to focus the company’s full attention on the execution of our strategic plan. Our new CEO Peter Sanderson is the ideal person to lead us into this new period. Peter has taken the helm with confidence, diligence and with a clear vision for our future.”

Thomas Schneider will be proposed at the next Annual General Meeting on 30 April 2020 for election as a new member of the BoD, subject to the customary regulatory approval. Thomas is currently Chairman of the BoD for listed Swiss bank Basellandschaftliche Kantonalbank. Thomas has extensive experience in auditing and advisory and brings in-depth knowledge of the Swiss market, having spent 27 years with Ernst & Young working with a variety of Swiss and financial services companies, including asset management institutions. After joining Credit Suisse in 2014, he was Chief Auditor for the International Wealth Management division and, most recently, Head of Internal Audit for Credit Suisse Switzerland AG, positions he held between 2014 and 2018. He is a Certified Swiss Accountant and holds an MSc in Business Administration from the University of Wales & GSBA Zürich. He was born in 1964 and is a Swiss citizen. Thomas will replace Hugh Scott-Barrett, who has decided not to stand for re-election at the upcoming AGM.

David Jacob, Chairman of GAM Holding AG, said: “I am delighted that Thomas Schneider has agreed to be put forward as a member of the Board of Directors for GAM. His deep audit knowledge and appreciation of both Swiss and global regulatory environments is the perfect complement to the extensive asset management experience we currently have on our Board.”

In order to streamline decision making and to provide a clearer allocation of responsibilities, the membership of the Group Management Board will change with effect from 1 April 2020 subject to regulatory approval, and include:

Peter Sanderson, Group Chief Executive Officer

Richard McNamara, Group Chief Financial Officer

Elmar Zumbuehl, Group Chief Risk Officer

Steve Rafferty, Group Chief Operating Officer

The current members stepping down from the GMB (Tim Rainsford, Group Head of Sales and Distribution; Rachel Wheeler, Group General Counsel; Martin Jufer, Group Head PLF and Region Head Continental Europe) will continue to have key senior roles in the revised senior leadership team, which is also being expanded to ensure greater connectivity and coordination across the firm.

Net fee and commission income decreased 34% to CHF 329.9 million compared with CHF 499.9 million in 2018. This was primarily driven by lower net management fees and commissions as a result of lower average AuM in investment management and lower management fee margins in investment management and private labelling, only partly offset by higher average AuM in private labelling. Net performance fees increased to CHF 12.8 million from CHF 4.5 million in 2018, with systematic, alternative investment solutions and fixed income strategies contributing the majority of these fees.

Personnel expenses decreased to CHF 197.0 million in 2019 from CHF 239.6 million in 2018. Variable compensation was 33% lower compared with 2018, mainly due to a decrease in discretionary and contractual bonuses as a result of business performance and lower revenues. Fixed personnel costs decreased 9%, mainly driven by the impact of our restructuring programme resulting in lower headcount. As at 31 December 2019, headcount was at 817 FTEs compared with 925 FTEs in the previous year.

General expenses were totalled CHF 99.6 million, a decrease of 22% compared with 2018. This was driven by the implementation of restructuring measures, lower discretionary spend and the impact of the new IFRS lease standard adopted in January 2019.

The operating margin stood at 4.3%, down from 25.3% in 2018. The decrease in net fee and commission income was only partly offset by lower expenses.

Net other (expenses)/income, which includes net interest income and expenses, the impact of foreign exchange movements, gains and losses on seed capital investments and hedging as well as fund-related fees and service charges, decreased by CHF 4.0 million and resulted in a net other expense of CHF 3.7 million in 2019 compared with a net other income of CHF 0.3 million in 2018. This was primarily driven by lower fund-related fees and service income as well as higher interest expenses and lower rent income from the sublease of certain office space as a result of the implementation of the new IFRS lease standard as of January 2019.

The underlying profit before taxes was CHF 10.5 million in 2019, down from CHF 126.7 million in 2018, driven by lower net fee and commission income and only partly offset by lower expenses, which continued to be managed tightly.

The underlying effective tax rate for 2019 was 53.3% compared with 22.5% in 2018. The effective tax rate increase was primarily driven by non-taxable holding company costs and expenses which are not tax deductible representing a significantly higher proportion of underlying profit before taxes.

Diluted underlying earnings per share were CHF 0.03, down from CHF 0.63 in 2018 resulting from the lower underlying net profit.

The IFRS net loss was CHF 3.5 million in 2019 compared with a net loss of CHF 916.8 million in 2018. In 2018, an impairment charge on the Group’s goodwill of CHF 872.0 million was recognised along with investment management and client contract impairment charges of CHF 183.7 million (net of taxes).

As announced on 30 January 2020, the Group has changed its accounting treatment in relation to future Cantab performance fees. Under this change, the Group has recognised a financial liability and as a consequence adjustments have been made to the values of intangible assets (goodwill as well as investment management and client contracts (IMCCs)) in relation to the Cantab acquisition. GAM has restated, where required, the comparative amounts relating to prior periods in its 2019 consolidated financial statements. The impact on the restated 2018 comparatives is an increase in net assets of CHF 42.0 million, no impact on the underlying profits and a reduction of the IFRS net loss by CHF 12.3 million. The five-year financial summary in the 2019 Annual Report reflects the restatement of historical amounts since 2016.

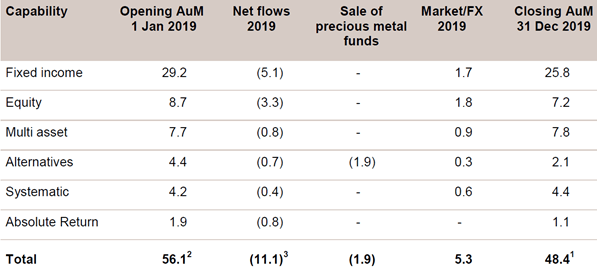

Assets under management movements (in CHF bn)

AuM totalled CHF 48.4 billion1 as at 31 December 2019, down from CHF 56.1 billion2 at year-end 2018, primarily driven by net outflows of CHF 11.1 billion3 across capabilities and the sale of precious metal funds as announced with the H1 2019 results, only partially offset by net positive market and foreign exchange movements of CHF 5.3 billion.

Net flows by capability

In fixed income, net outflows totalled CHF 5.1 billion, primarily driven by the GAM Greensill Supply Chain Finance, GAM Local Emerging Bond and GAM Emerging Bond funds as well as some institutional mandates that recorded client redemptions, which were only partially offset by inflows into the GAM Star Credit Opportunities fund and GAM Cat Bond strategies.

In equity, GAM saw net outflows of CHF 3.3 billion. Net inflows in the GAM Star European Equity, GAM UK Equity Income, GAM Emerging Markets Equity funds and inflows into a Japanese institutional equity mandate were more than offset primarily by withdrawals from the GAM Star Continental European Equity, GAM Japan Equity, GAM Star China Equity, GAM Europe Focus Equity and GAM Euroland Value Equity funds.

Multi asset strategies experienced net outflows of CHF 0.8 billion in 2019, driven by redemptions from institutional and private clients.

In alternatives, GAM saw net outflows of CHF 0.7 billion, with inflows into the GAM Select fund more than offset by outflows from institutional mandates. In addition, AuM further decreased by CHF 1.9 billion from the sale of the precious metal funds to ZKB as announced with the H1 2019 results. GAM continues to act as the fund management company for the precious metal funds through its PLF business.

In systematic, net outflows of CHF 0.4 billion were driven by outflows from the CCP Quantitative and CCP Core Macro funds, only partly offset by inflows into the alternative risk premia strategies.

The absolute return category recorded net outflows of CHF 0.8 billion, mainly from the GAM Star Global Rates, GAM Star (Lux) European Alpha and GAM Absolute Return Europe funds.

Investment performance

Over the three-year period to 31 December 2019, 74% of AuM in funds outperformed their respective benchmark compared with 66% as at 31 December 2018. This increase was primarily driven by a stronger performance of certain fixed income and systematic strategies. Over the five-year period to 31 December 2019, 78% of AuM in funds outperformed their respective benchmark, up from 63% as at 31 December 2018. This increase was primarily driven by the improved performance of certain fixed income, systematic and equity strategies. 27% and 86% of GAM’s AuM tracked by Morningstar4 outperformed their respective peer groups over three and five years to 31 December 2019.

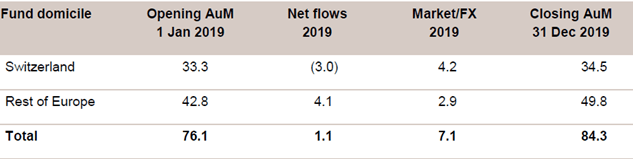

Assets under management movements (in CHF bn)

As at 31 December 2019, AuM had risen to CHF 84.3 billion, from CHF 76.1 billion at the end of 2018. This was driven by net inflows of CHF 1.1 billion, including CHF 1.9 billion from the sale of the precious metal funds to ZKB for which GAM continues to act as the fund management company through its PLF business, as well as net positive market and foreign exchange movements of CHF 7.1 billion. In 2019, PLF launched 24 new funds leading to 217 operated third party funds, reflecting increased client demand as well as the scalability of the platform and making GAM one of the largest non-bank fund solution providers in Europe.

Cash and cash equivalents at the end of 2019 amounted to CHF 315.8 million, down from CHF 328.2 million in 2018, reflecting the net redemptions of investments in seed capital and cash flows generated from operating activities being more than offset by acquisition-related deferred consideration payments primarily related to Cantab, payments associated with redundancies in connection with the restructuring programme, and expenditure capitalised relating to the London office move.

Adjusted tangible equity5 increased to CHF 197.2 million from CHF 184.6 million in 2018. The main contributor to this increase was that the IFRS net loss was more than offset by the impairment and amortisation of IMCCs.

The BoD intends to put in place a new three-year share buy-back programme after the current programme expires on 30 April 2020. The new programme will provide the Group with future flexibility to return excess capital to shareholders once capital buffers are enhanced. The new share buy-back programme will allow GAM to repurchase up to 16.0 million shares over a maximum period of three years. It will be executed at the SIX Swiss Exchange over a second trading line where GAM Holding AG acts as sole buyer and the transactions are funded from the Group’s cash flows.

Recognising GAM’s low level of underlying net profit in 2019, the BoD proposes to shareholders that no dividend be paid for 2019. The BoD continues to target a minimum dividend pay-out of 50% of underlying net profit to shareholders.

For the financial year 2019, no variable compensation will be paid to the GMB, which demonstrates its accountability and further follows GAM’s key principle in linking compensation to the Group’s overall performance. In the future, long-term incentive awards will remain a part of GAM’s compensation framework as they are an integral part of the overall compensation package, aligning management with shareholders and emphasising the long-term nature of the overall compensation paid to GAM’s senior management. Further, Group CEO Peter Sanderson was eligible for a CHF 250,000 one-off fixed cash award to be paid following the Annual General Meeting 2020. In recognition of the financial performance of the Group and in alignment with the other members of the GMB, Peter Sanderson requested to forego this award.

GAM expects the market environment to remain volatile and investors are likely to remain cautious. However, with its distinctive set of investment strategies and global distribution capabilities, it is well positioned to support clients in achieving their long-term investment goals and to grow. As we enter 2020, we are seeing stabilisation of net flows with broad-based demand. GAM is fully focused on implementing its new strategy, which is based on efficiency, transparency and growth to achieve its new financial targets and thus make it fit for the future.

The presentation for analysts and investors on the results of GAM Holding AG for 2019 will be webcast on 20 February 2020 at 8:30am (CET). A presentation for media will be webcast at 11:00am (CET). Materials relating to the results (presentation slides, 2019 Annual Report and press release) are available at www.gam.com.

2 Excluding CHF 1.45 billion ARBF-related assets under management in liquidation as at 31 December 2018.

3 Excluding ARBF-related assets under management liquidated in FY 2019.

4 The peer group comparison is based on ‘industry-standard’ Morningstar Direct Sector Classification. The share class preferences in Morningstar have been set to capture the oldest institutional accumulation share class for each and every fund in a given peer group.

5 Adjusted tangible equity is defined as equity excluding goodwill and other intangible assets as well as the financial liability relating to 40% of future Cantab performance fees which only materialises when a corresponding asset is recognised.

| 23 April 2020 | Q1 2020 Interim management statement |

| 30 April 2020 | Annual General Meeting |

| 04 August 2020 | Half-year results 2020 |

| 21 October 2020 | Q3 2020 Interim management statement |

| Charles Naylor | ||||||||

| Global Head of Communications and Investor Relations |

||||||||

| T +44 20 7917 2241 | ||||||||

| Investor Relations | Investor Relations | Media Relations | ||||||

| Tobias Plangg | Jessica Grassi | Kathryn Jacques | ||||||

| T +41 (0) 58 426 31 38 | T +41 (0) 58 426 31 37 | T +44 20 7393 8699 | ||||||

Visit us at: www.gam.com

Follow us on: Twitter, LinkedIn

GAM is a leading independent, pure-play asset manager. The company provides active investment solutions and

products for institutions, financial intermediaries and private investors. The core investment business is

complemented by private labelling services, which include management company and other support services to thirdparty

asset managers. GAM employed 817 FTEs in 14 countries with investment centres in London, Cambridge,

Zurich, Hong Kong, New York, Milan and Lugano as at 31 December 2019. The investment managers are supported

by an extensive global distribution network. Headquartered in Zurich, GAM is listed on the SIX Swiss Exchange with

the symbol ‘GAM’. The Group has AuM of CHF 132.7 billion1 (USD 137.0 billion) as at 31 December 2019.

This press release by GAM Holding AG (‘the Company’) includes forward-looking statements that reflect the

Company’s intentions, beliefs or current expectations and projections about the Company’s future results of

operations, financial condition, liquidity, performance, prospects, strategies, opportunities and the industry in which it

operates. Forward-looking statements involve all matters that are not historical facts. The Company has tried to

identify those forward-looking statements by using words such as ‘may’, ‘will’, ‘would’, ‘should’, ‘expect’, ‘intend’,

‘estimate’, ‘anticipate’, ‘project’, ‘believe’, ‘seek’, ‘plan’, ‘predict’, ‘continue’ and similar expressions. Such statements

are made on the basis of assumptions and expectations which, although the Company believes them to be

reasonable at this time, may prove to be erroneous.

These forward-looking statements are subject to risks, uncertainties, assumptions and other factors that could cause

the Company’s actual results of operations, financial condition, liquidity, performance, prospects or opportunities, as

well as those of the markets it serves or intends to serve, to differ materially from those expressed in, or suggested

by, these forward-looking statements. Important factors that could cause those differences include, but are not limited

to: changing business or other market conditions, legislative, fiscal and regulatory developments, general economic

conditions, and the Company’s ability to respond to trends in the financial services industry. Additional factors could

cause actual results, performance or achievements to differ materially. The Company expressly disclaims any

obligation or undertaking to release any update of, or revisions to, any forward-looking statements in this press

release and any change in the Company’s expectations or any change in events, conditions or circumstances on

which these forward-looking statements are based, except as required by applicable law or regulation.