Given an improving risk/return backdrop for emerging markets (EM), Tim Love, believes now is a good time to revisit a grouping he coined in November 2020 called “START” (Samsung Electronics, Tencent, Alibaba, Reliance and TSMC) which represent well the cyclical and secular opportunities for the EM region.

09 February 2023

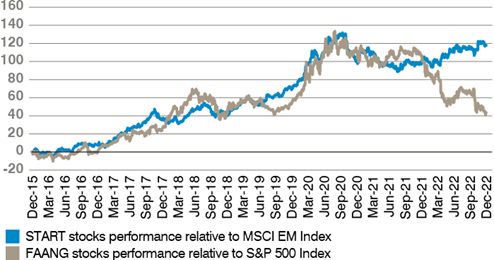

Tim contrasts this grouping to the US-listed FAANG (Facebook/Meta, Amazon, Apple, Netflix and Google/Alphabet), outlining why he believes START are key enablers of the ongoing digital revolution, represent strong growth opportunities and also reflect key sustainable shifts in the region across both consumer and enterprise.

A new dawn for EM?

At last, we think EM equities are showing signs of marking the end of 11 years of relative de-rating versus developed markets (DM). The relative argument to DM has been delayed by the 25-year dollar highs, measured by the real effective exchange rate (REER), as well as the extension of China’s zero Covid policy into November 2022, much longer than most predicted. Now the question is what is the expected recovery of EM equities if this is the end of the down cycle?

By the end of the Asian Crisis followed by SARS (SARS-CoV-1 of 2002-03), the EM de-rating was similarly large and tortuous, with a more than 50% fall in dollar terms. But the subsequent 2003-08 recovery of approximately 400% up to the end of December 2007 marked an outperformance not seen since Japan’s ninefold increase from 1982-90 as it was elevated to MSCI DM and World Trade Organization (WTO) status. We believe the same outperformance can repeat and that the relative outperformance this time will be driven by crossover liquidity flows and reversals of extreme negative sentiment.

Why START?

What is the appropriate asset allocation to capture this potential upside? We believe a good blend of both growth at a reasonable price (GARP) and value. GARP is well supported in index composition, with higher representation of the consumer and technology sectors, and therefore provides more structural and secular themes. With improving domestic demand, reform packages and expectations of lower weighted average cost of capital (WACC) as orthodox EM central banks unwind tight monetary policy, it is likely that in 2023 GARP will be a strong beneficiary. Hence we believe it is worth revisiting “START not FAANGs” once again.

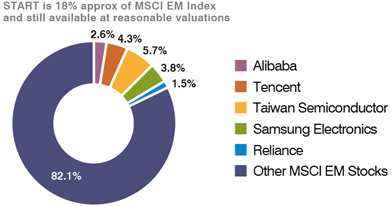

The START companies are more diversified with strong growth, competitive and technology advantages with dominant market positioning in their industries, in our view. Very strong capital positions could also put them in a strong position for shareholder enhancing return policies. START, which we outline in more detail below, constitutes 18% of the MSCI EM index and we believe provides an excellent opportunity to invest in the transformational story of EM.

Figure 1: START accounts for 18% of MSCI EM Index

Figure 2: START stocks performance relative to their benchmarks

Samsung Electronics

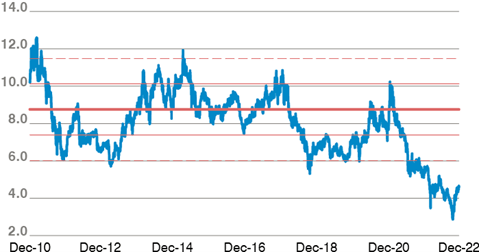

Samsung Electronics is a global leader with superior vertical integration across semiconductors, telecommunications and digital convergence – key building blocks for the digital era. Its leading edge in foundry and memory chips has been offset recently by a cyclical adjustment, though with increased silicon input across modern devices and products, and rational industry structures (oligopoly in foundry and increasingly memory), we expect strong returns ahead. A key share driver is the memory cycle and with the trough expected to occur in the first half of 2023, it would be reasonable to see share prices bottom ahead of this trough (ie, in the very near term) in line with previous cycles. We believe self and government-driven governance reform is likely to support improved shareholder returns while a hefty cash balance puts the company in a good position to make accretive acquisitions.

Figure 3: Samsung forward 12-month price-to-book

Tencent Holdings

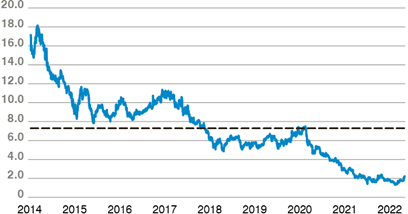

With a strong presence across gaming, social media and payments, Tencent dominates online traffic in China and is likely to be a key beneficiary of the post Covid era. As the largest online community in China, its main revenue sources are value-added services, including PC and mobile games, fintech and online advertising. Increased monetisation of its social media platforms (e-commerce/video accounts) could drive an improving margin profile into a broader recovery which can be further enhanced by a government shift to a more supportive stance to platform companies and the recent relaxation of game approvals (88 game approvals in January alone). The stock has bounced from extreme October 2022 lows but still trades towards the bottom end of historic valuation ranges as it enters what we regard as a margin and earnings growth upswing.

Figure 4: Tencent forward 12-month price-to-sales

Alibaba

Severe Covid restrictions over a prolonged period have led to a strong build-up of excess savings in China (street estimates between USD 750 billion to USD 2 trillion) which are likely to be deployed as the economy opens up and Alibaba, as the dominant and most profitable e-commerce leader, is likely to be a key beneficiary. At ground zero regarding government scrutiny of platform companies, the recent shift by the government to a more supportive stance in this area is a strong tailwind at a time when valuations have been compressed by regulation and the broader slowdown. Leveraging its data intelligence, in recent years the company has expanded into offline retail, food delivery, logistics and cloud computing, which significantly increased its addressable market, but these initiatives also pressurised margin at a time of broader economic malaise. Over the next few years, these losses are expected to significantly shrink and, coupled with the broader recovery, sets up a strong earnings growth profile over future years at a time when valuations remain depressed even after the share price recovery from October 2022 lows.

Figure 5: Alibaba forward 12-month price to sales

Reliance Industries

Reliance is one of our favourite transition stories, transforming itself from primarily an energy extractor and processor to a more modern, technology focused and environmental conscious consumer-facing business. Over 80% of the company’s capital expenditure over the next few years is projected to be in the new energy, telecom and retail businesses, and its ambition to achieve carbon neutrality before 2035 is bold among its peers. The company aims to create an entire ecosystem of non-polluting energy with a focus on manufacturing integrated solar photovoltaic modules, hydrogen electrolysers, fuel cells and batteries to store energy from the grid. It has built strategic partnerships with innovators in this space and invested circa USD 1.5 billion to build on its technology until now. We also see chances for an IPO of Jio and/or retail within the next two to three years.

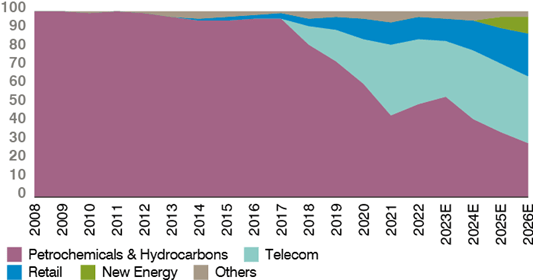

Figure 6: Hydrocarbons & petrochemical business is estimated to reduce from 54% in FY23 to 29% by FY26

Taiwan Semiconductor

TSMC is firmly positioned as the key enabler of the new computing revolution with approximately 60% foundry market share with a strong competitive edge in leading nodes. Market share, multiple architectures, chip platforms, design teams and increasing demand for advanced technology have supported a steady rise in return on equity (ROE) which hit over 30% in 2022. The company’s Q4 2022 results and 2023 guidance was a “reset” to reflect the current inventory build up and slower demand environment and a weak H1 2023 now largely discounted in valuations. We believe industry structure and new technology offerings (the company is very positive on the response to its latest 3 nm chips) is likely to support a healthy ROE in 2023, despite this year being a trough year, and this year’s ROE is 7% above the previous trough. TSMC is guiding in 2023 for a +29% half-on-half recovery and sustainable growth ahead driven by next gen nodes (3 nm), high performance computing, AI chip advances, connectivity (Edge/5G+) and industrial applications (EV, automated driving).

Figure 7: TSMC forward 12-month price-to-earnings

Key risks we are monitoring include hawkish central banks potentially looking through current easier inflation prints and continuing to raise rates beyond expectations into what is clearly a weakening developed world growth environment. This would increase the likelihood and depth of a potential recession which typically comes with, or triggers, other risk events. One such driver of a hawkish stance could be an event driving energy prices higher than expected which is possible in the current geopolitical environment. Broader geopolitics is also an uncertainty with Ukraine entracted in a current stalemate with room for error. Following China’s Party Congress, there does seem to be some form of easing in US-China relations though escalation in this relationship remains a risk and would be a significant negative to START with three out of five stocks in the Greater China region.

To conclude, we believe START is more diversified than FAANG, with strong growth, competitive and technology advantages and dominant market positioning in their respective industries. START constitutes 18% of the MSCI EM index and we believe it provides an excellent opportunity to invest in the transformational story of EM at a key inflection point in its history, namely as an enviable investment grade laggard appealing to global value, growth and yield investors.

Important disclosures and information

The information in this document is given for information purposes only and does not qualify as investment advice. Opinions and assessments contained in this document may change and reflect the point of view of GAM in the current economic environment. No liability shall be accepted for the accuracy and completeness of the information. Past performance is no indicator of current or future trends. The mentioned financial instruments are provided for illustrative purposes only and shall not be considered as a direct offering, investment recommendation or investment advice or an invitation to invest in any GAM product or strategy. Reference to a security is not a recommendation to buy or sell that security. The securities listed were selected from the universe of securities covered by the portfolio managers to assist the reader in better understanding the themes presented. The securities included are not necessarily held by any portfolio or represent any recommendations by the portfolio managers.

No guarantee or representation is made that investment objectives will be achieved.

References to indexes and benchmarks are hypothetical illustrations of aggregate returns and do not reflect the performance of any actual investment. Investors cannot invest in indices which do not reflect the deduction of the investment manager’s fees or other trading expenses. Such indices are provided for illustrative purposes only. Indices are unmanaged and do not incur management fees, transaction costs or other expenses associated with an investment strategy. Therefore, comparisons to indices have limitations.

This presentation contains forward-looking statements relating to the objectives, opportunities, and the future performance of the markets generally. Forward-looking statements may be identified by the use of such words as; “believe,” “expect,” “anticipate,” “should,” “planned,” “estimated,” “potential” and other similar terms. Examples of forward-looking statements include, but are not limited to, estimates with respect to financial condition, results of operations, and success or lack of success of any particular investment strategy. All are subject to various factors, including, but not limited to general and local economic conditions, changing levels of competition within certain industries and markets, changes in interest rates, changes in legislation or regulation, and other economic, competitive, governmental, regulatory and technological factors affecting a portfolio’s operations that could cause actual results to differ materially from projected results. Such statements are forward-looking in nature and involve a number of known and unknown risks, uncertainties and other factors, and accordingly, actual results may differ materially from those reflected or contemplated in such forward-looking statements. Prospective investors are cautioned not to place undue reliance on any forward-looking statements or examples. None of GAM or any of its affiliates or principals nor any other individual or entity assumes any obligation to update any forward-looking statements as a result of new information, subsequent events or any other circumstances. All statements made herein speak only as of the date that they were made.