Tuesday, March 1, 2016

GAM Holding AG 2015 underlying pre-tax profit CHF 197.8 million

- Underlying pre-tax profit of CHF 197.8 million, down 9%

- IFRS net profit of CHF 138.3 million, down 18% after a reorganisation charge and other non-recurring and acquisition-related items

- Diluted underlying earnings per share of CHF 0.98 (CHF 1.06 in 2014)

- Net fee and commission income down 1% to CHF 600.6 million, of which net performance fees up 26% to CHF 82.8 million

- Expenses down 1% to CHF 403.5 million, with both personnel and general expenses lower

- Group assets under management of CHF 119.0 billion as at 31 December 2015 (CHF 123.2 billion as at 31 December 2014)

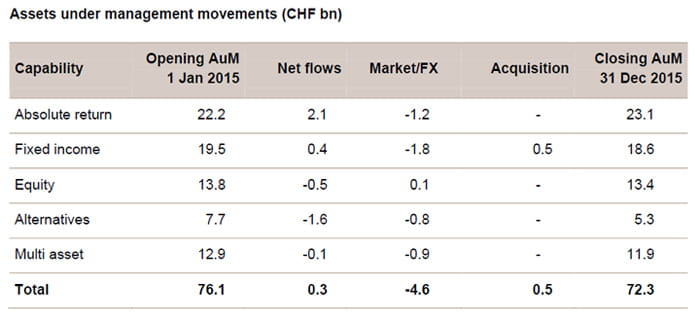

- Investment management with CHF 0.3 billion net inflows; assets under management down 5% to CHF 72.3 billion, reflecting negative market and foreign exchange movements

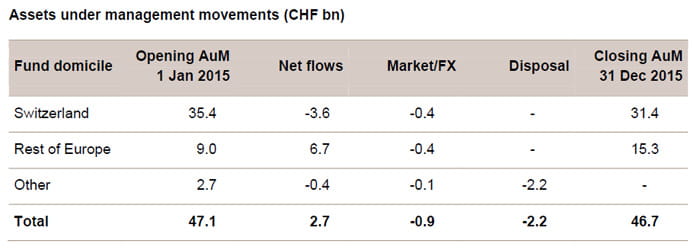

- Private labelling with CHF 2.7 billion net inflows; assets under management down 1% to CHF 46.7 billion, reflecting sale of the Cayman business

- Proposed dividend of CHF 0.65 per share, unchanged from previous year

- Larry Hatheway and Tim Dana to join the Group Management Board, subject to customary regulatory approval; Andrew Hanges to step down from the Group Management Board

Group CEO Alexander S. Friedman said: “One year ago we set out our strategic agenda for the coming years. Since then we have focused on disciplined execution, addressing three critical areas: our brand, our operating model and our growth strategy. While the transition is not yet complete, we have made good progress, even against a challenging market backdrop.

The work we undertook in 2015 is not yet fully visible in our financial results. This is not a surprise – we always knew our plans would take a few years to be realised in their entirety. The transition we embarked on is proceeding on schedule and will give GAM a solid foundation for future profitable growth. Even in difficult times, our business is resilient and well positioned to take advantage of the opportunities we see in our industry over the coming years. Following the strategic steps initiated in 2015, we are focused on executing against our plans, and we have a number of exciting product launches in the pipeline.

2016 has begun with renewed turbulence in the financial markets. Diverging monetary policy against the backdrop of weak global growth along with concerns over the economic slowdown in China and the trajectory of oil prices are keeping markets volatile. Furthermore, worries about broader financial stress at a time when central banks and regulators may be limited in their tools to respond are affecting investor sentiment and flows. Investing will, no doubt, be challenging. As high-conviction active asset managers with a strong range of absolute return strategies, the environment ahead should provide opportunities for us to outperform, but we will not be immune to negative market trends.”

Net fee and commission income fell 1% to CHF 600.6 million. The 5% decline in the net management fees and commissions to CHF 517.8 million (mainly as a result of a decline in the management fee margin in investment management to 64.6 basis points driven by the mix of net flows across products and client segments) was largely offset by a 26% increase in net performance fees to CHF 82.8 million.

Net other income, which includes net interest income, the impact of foreign exchange movements, gains and losses on seed capital investments and hedging as well as fund-related fees and service charges, fell to CHF 0.7 million from CHF 14.7 million. Losses from foreign exchange movements (compared with gains in the previous year), lower net gains on seed capital and negative interest on the Group’s Swiss franc cash deposits contributed to this decline.

Personnel expenses decreased 1% to CHF 290.0 million, with declines in both fixed and variable compensation. The compensation ratio remained largely unchanged at 48.3% (48.2% in 2014), demonstrating the alignment between revenues and compensation structures.

General expenses decreased 1% to CHF 104.9 million, reflecting the firm’s cost discipline and a decline in IT costs.

The underlying pre-tax profit decreased 9% to CHF 197.8 million. While costs were managed tightly and variable compensation reduced, the decrease in net fee and commission income and net other income could not be entirely offset by an equivalent reduction in expenses.

The underlying effective tax rate increased to 19.9% from 18.2%, reflecting a shift in the geographic split of the Group’s earnings. Diluted underlying earnings per share were 8% lower at CHF 0.98, benefiting from the reduction in the number of shares outstanding through the Group’s share buy-back programme.

The IFRS net profit of CHF 138.3 million, all attributable to the shareholders of GAM Holding AG, was 18% lower than in 2014 as a result of non-recurring and acquisition-related items. Non-recurring items led to a net charge of CHF 6.2 million and included a net charge of CHF 9.5 million for the reorganisation of the business (mainly redundancy payments over the course of 2016 net of a pension fund curtailment credit) and CHF 1.2 million in deal and integration costs for corporate transactions. These were partly offset by the CHF 4.5 million gain on the sale of the Cayman fund administration business. Net charges for acquisition-related items amounted to CHF 13.9 million and included an adjustment to deferred consideration liabilities and the amortisation of client relationships from previous acquisitions.

In investment management, assets declined by CHF 3.8 billion to CHF 72.3 billion. Net inflows of CHF 0.3 billion and assets of CHF 0.5 billion acquired with the real estate debt business of Renshaw Bay were offset by the negative impact from markets (CHF 2.4 billion) and foreign exchange movements (CHF 2.2 billion, reflecting the strengthening of the Swiss franc).

Net flows by capability

Investors added net CHF 2.1 billion to absolute return strategies in 2015. The unconstrained / absolute return bond strategy saw redemptions from financial intermediaries following weak performance in the second half of 2014 and 2015, but continued to win substantial inflows from institutional investors thanks to its ten-year track record of capital protection across market cycles. The JB Absolute Return Europe fund, which takes long and short positions in equities and equity-related securities of European companies, attracted strong inflows, as did the GAM Star Global Rates fund.

In fixed income, the GAM Star Credit Opportunities fund, which predominantly invests in investment grade debt or high-quality issuers, attracted solid inflows, as did specialised products such as the GAM Star MBS Total Return and GAM Star Cat Bond funds. These were moderated by outflows in emerging market strategies, driven by investor sentiment. Net inflows into fixed income strategies totalled CHF 0.4 billion in 2015.

The largest inflows into equity strategies came from the JB Japan fund as strong performance helped drive client demand. The GAM Star Continental European fund also saw solid inflows, while GAM Star China posted outflows amid negative investor sentiment despite outperformance versus benchmark. GAM Star US All Cap Equity, managed externally, also saw outflows following a prolonged period of weak performance. Net outflows from equity strategies totalled CHF 0.5 billion in 2015.

Overall net outflows in multi asset products were CHF 0.1 billion for the year. Good net inflows into institutional relative return products and mandates as well as risk rated solutions for financial advisers were more than offset by redemptions in private client advisory and mandates stemming from GAM’s previous affiliation with UBS and Julius Baer as well as in lower-margin institutional mandates.

Net outflows from alternatives amounted to CHF 1.6 billion, mainly reflecting withdrawals from alternative risk premia mandates, traditional funds of hedge funds and the JB Physical Gold Fund.

Net flows by client segment

Net inflows from institutional investors amounted to CHF 1.3 billion in 2015 as strong inflows in the first half of the year were partly offset by redemptions and the loss of two alternative risk premia mandates in the second half. Net outflows from private clients of CHF 1.1 billion were mainly related to GAM’s previous captive channels. Financial intermediaries contributed CHF 0.1 billion to net inflows for the year as redemptions in the fourth quarter almost offset solid inflows in the first nine months.

Assets under management in private labelling fell to CHF 46.7 billion from CHF 47.1 billion a year earlier. The loss of one large mandate in the second half of the year was more than offset by new business wins in Switzerland and Italy, leading to net inflows of CHF 2.7 billion in 2015. This was counteracted by the sale of our fund administration business in the Cayman Islands, which reduced assets by CHF 2.2 billion, and negative market and foreign exchange movements that led to a CHF 0.9 billion decrease.

The Group’s balance sheet continues to be highly liquid (cash and cash equivalents of CHF 632.9 million as at 31 December 2015) and strongly capitalised (tangible equity of CHF 487.0 million as at 31 December 2015). The strong cash flow generation of the Group’s operating activities, combined with low capital consumption, forms a solid basis for a continued policy of shareholder distributions.

At the upcoming Annual General Meeting (AGM) of GAM Holding AG on 27 April 2016, the Board of Directors will propose a dividend of CHF 0.65 per share for the 2015 financial year, unchanged from the previous year, representing an estimated total distribution of about CHF 103 million or 65% of the underlying net profit. This underscores the Board’s commitment to maintaining its policy of progressive, sustainable and predictable dividends, increasing in line with earnings growth through the business cycle. The dividend will be paid as at 3 May 2016 from capital contribution reserves and will therefore be exempt from Swiss withholding tax.

In 2015, GAM Holding AG returned CHF 55.5 million in cash to shareholders through the buy-back of 3.1 million of its own shares for the purpose of cancellation. The current share buy-back programme, which started on 28 April 2014, allows for the repurchase of up to 16.7 million shares over a maximum period of three years (31% had been utilised by the end of December 2015) and represents a flexible means of returning excess capital to shareholders in the absence of other opportunities for investment.

At the upcoming AGM, the Board of Directors will propose the creation of authorised capital equal to 20% of GAM Holding AG’s current share capital. Subject to shareholder and customary regulatory approval, this proposal is designed to further enhance GAM’s strategic flexibility – for instance in taking advantage of future opportunities for acquisitions that meet the Group’s strict financial criteria. The proposal would allow the Board of Directors to increase the share capital at any time until 27 April 2018 by a maximum amount of CHF 1,633,946 by issuing a maximum of 32,678,920 fully paid registered shares with a par value of CHF 0.05 each. Of these 32,678,920 fully paid registered shares, the Board would be authorised to restrict or withdraw the pre-emptive rights of the existing shareholders with respect to a maximum of 16,339,460 registered shares and allocate such rights to third parties in certain cases, such as for acquisitions. Full details of the proposal will be published in the invitation to the AGM.

Larry Hatheway, Group Chief Economist and Group Head of Multi Asset Portfolio Solutions, and Tim Dana, Group Head of Corporate Development, will join the Group Management Board on 1 May 2016, subject to the customary approval by the Swiss Financial Market Supervisory Authority FINMA. Larry Hatheway and Tim Dana both joined GAM in late 2015.

Andrew Hanges, Region Head UK, will step down from the Group Management Board on the same date and focus on his work as a board member of various investment funds and regulated entities within the Group.

Alexander S. Friedman, Group CEO, said: “On behalf of the Group Management Board, I would like to thank Andy for his contribution and his commitment as a member of that body and I look forward to welcoming Larry and Tim as members of our senior leadership team.”

The implementation of the new operating model, as communicated with GAM’s 2015 half-year results, is well on track. By full-year 2017, this will lead to a structural annual cost reduction of more than CHF 20 million compared with the 2014 level. The reorganisation was provisioned for in 2015 and is not expected to result in additional charges in 2016.

GAM thoroughly assessed its investment management product range and closed or merged 41 funds in 2015 with a de minimis loss of client assets as a result of these measures. Apart from allowing the Group to focus resources most effectively, this also creates capacity to develop and support new product launches to drive organic growth. For example, the Group recently launched a market neutral US equity strategy, based on the highly successful JB Absolute Return Europe fund. The Group is also developing a new range of multi asset offerings, an institutional trade finance strategy and a second real estate debt fund.

As announced in 2015, GAM streamlined its private labelling activities by selling its fund administration business in the Cayman Islands. Private labelling will now focus on the provision of management company services and tailored third-party solutions for funds domiciled in Europe.

The acquisition of Renshaw Bay’s real estate debt business closed in October 2015, adding CHF 0.5 billion in assets under management in the fourth quarter. GAM intends to launch a second real estate debt fund by mid-year, following the successful investment of the capital raised for the first fund that closed to new subscriptions in 2015.

In November 2015, GAM unveiled a redesigned brand and a new website and started a targeted external marketing campaign to better reflect the evolving nature of the Group.

The Group affirms its financial targets. Over a business cycle, defined as five to eight years, the Group aims to:

- increase diluted underlying earnings per share in excess of 10% on an annualised basis

- achieve an operating margin of 35-40%

Compared with the targets communicated in March 2015, diluted underlying EPS replaces the previously used basic underlying EPS to reflect the dilution impact from share-based compensation plans. The operating margin target is consistent with the previously disclosed cost/income ratio target of 60-65%. The operating margin excludes the impact of net other income to provide a better representation of the Group’s operating performance.

The presentation for media, analysts and investors on the GAM Holding AG results for 2015 will be webcast on 1 March 2016 at 9 am (CET). Materials related to the results (Annual Report 2015, presentation slides and press release) are available at www.gam.com.

| 20 April 2016 | Interim management statement Q1 2016 |

| 27 April 2016 | Annual General Meeting |

| 29 April 2016 | Ex-dividend date |

| 2 May 2016 | Dividend record date |

| 3 May 2016 | Dividend payment date |

| 3 August 2016 | Half-year results 2016 |

| 20 October 2016 | Interim management statement Q3 2016 |

Media Relations:

Elena Logutenkova

T: +41 (0) 58 426 63 41

Investor Relations:

Patrick Zuppiger

T: +41 (0) 58 426 31 36

Visit us at: www.gam.com

Follow us on: Twitter, LinkedIn and XING

GAM is one of the world’s leading independent, pure-play asset managers. The company provides active investment solutions and products for institutions, financial intermediaries and private investors under two brands: GAM and Julius Baer Funds. The core investment business is complemented by private labelling services, which include management company and other support services to third-party asset managers. GAM employs over 1,000 people in 11 countries with investment centres in London, Zurich, Hong Kong, New York, Milan and Lugano. The investment managers are supported by an extensive global distribution network.

Headquartered in Zurich, GAM is listed on the SIX Swiss Exchange and is a component of the Swiss Market Index Mid (SMIM) with the symbol ‘GAM’. The Group has assets under management of CHF 119.0 billion (USD 118.9 billion) as at 31 December 2015.

This press release by GAM Holding AG (‘the Company’) includes forward-looking statements that reflect the Company’s intentions, beliefs or current expectations and projections about the Company’s future results of operations, financial condition, liquidity, performance, prospects, strategies, opportunities and the industry in which it operates. Forward-looking statements involve all matters that are not historical facts. The Company has tried to identify those forward-looking statements by using words such as ‘may’, ‘will’, ‘would’, ‘should’, ‘expect’, ‘intend’, ‘estimate’, ‘anticipate’, ‘project’, ‘believe’, ‘seek’, ‘plan’, ‘predict’, ‘continue’ and similar expressions. Such statements are made on the basis of assumptions and expectations which, although the Company believes them to be reasonable at this time, may prove to be erroneous.

These forward-looking statements are subject to risks, uncertainties, assumptions and other factors that could cause the Company’s actual results of operations, financial condition, liquidity, performance, prospects or opportunities, as well as those of the markets it serves or intends to serve, to differ materially from those expressed in, or suggested by, these forward-looking statements. Important factors that could cause those differences include, but are not limited to: changing business or other market conditions, legislative, fiscal and regulatory developments, general economic conditions, and the Company’s ability to respond to trends in the financial services industry. Additional factors could cause actual results, performance or achievements to differ materially. The Company expressly disclaims any obligation or undertaking to release any update of, or revisions to, any forward-looking statements in this press release and any change in the Company’s expectations or any change in events, conditions or circumstances on which these forward-looking statements are based, except as required by applicable law or regulation.